The decline of the US dollar allowed the gold price to correct upwards, reaching $1916 an ounce in early trading Wednesday. The price stabilized around $1890 an ounce at the time of this writing. It is expected that instability will continue to dominate the financial markets’ performance until the final US elections results are announced. As the vote count is still ongoing, gold prices rose as the dollar weakened, in the hopes that the US government will soon announce a fiscal stimulus. The focus is on the presidential election, as investors hope that Democrat Joe Biden, if he manages to oust President Donald Trump, will press for a greater fiscal stimulus and a freer approach to global trade. Biden is said to be leading in national opinion polls and is also leading in several major swing states in the race.

There is optimism that the election results will be announced at the end of the night without the need for lawsuits and a recount.

To win the US presidency, a candidate must win at least 270 of the country's 538 Electoral College votes. Since adopting the split voting system in 1991, Nebraska has divided its electoral votes only once: in 2008, when Democrat Barack Obama won the second district on his way to the presidency.

Both investors and economists have been calling for a renewal of US stimulus since the last round of supplementary benefits for laid-off workers and other forms of support approved earlier by Congress ended. At the same time, investors see cases of optimism in other electoral scenarios as well. Trump's victory could mean continuing low tax rates and tighter regulation of companies, boosting corporate profits that are the lifeblood of the stock market.

What matters to many professional investors is what is happening with the pandemic and whether a vaccine can soon be found to help the economy recover.

Currently, many European governments are reinstating restrictions imposed on companies to limit the exacerbation of the number of COVID-19 cases. The increasing infections in the United States raise concerns that fear of the virus alone can harm business, as people stay at home and thus spend less, which could weaken the US economy.

The markets also await monetary policy decisions led by Jerome Powell and then details of the US jobs report by the end of the week.

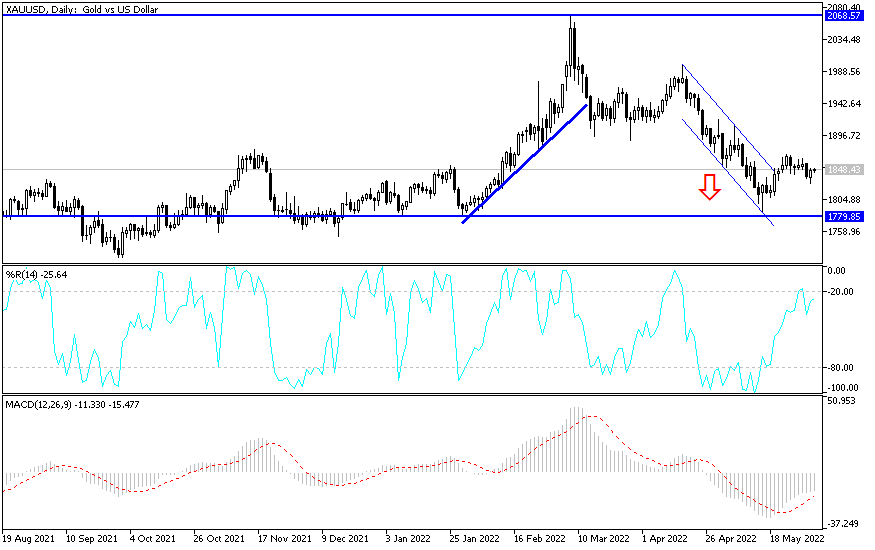

Technical analysis of gold:

There is no change in my technical view of the price of gold, as stability above the $1900 resistance will continue to support the bulls to launch towards stronger resistance levels, the closest of which are currently at 1917, 1928 and 1955, respectively. These resistance levels are important for the move towards the historic resistance level at $2000 again. On the downside, the support level at $1885 will remain important to confirm how much the bears are in control of the performance. I still prefer to buy gold from every drop.

In addition to the extent of investors’ risk appetite, the price of gold will interact with the results of the US elections, the services PMI reading from China, the Eurozone, Britain and the United States, and then to the first statement of US jobs, which is the ADP survey to measure the change in US non-farm jobs.