Investors' abandonment of safe havens and the recovery of the USD pushed the gold price to decline sharply at the beginning of this week’s trading. The metal reached $1831 an ounce after a downward stability at the beginning of this week’s trading around $1876 an ounce. Gold prices have fallen sharply as investors embrace riskier assets amid improved risk sentiment after the latest positive updates regarding COVID-19 vaccines. Similarly, silver futures closed lower at $23,633 an ounce, while copper futures settled at $3.2580 a pound.

After investor sentiment improved last week in response to updates from Pfizer and Moderna, the University of Oxford and AstraZeneca Pharma announced that their new coronavirus vaccine could be 90% effective under one dose regimen.

AstraZeneca CEO Pascal Suriot said: “Today marks an important milestone in our fight against the pandemic. The effectiveness and safety of this vaccine confirms that it will be highly effective against COVID-19 and will have an immediate effect on this public health emergency.” Meanwhile, Food and Drug Administration officials are scheduled to meet on December 10 to review Pfizer's application for emergency distribution of its vaccine.

Accordingly, investors believe that the progress of the vaccine was one of the main drawbacks for bullions, because it reduces the attractiveness of gold and silver.

Optimism about COVID-19 vaccines and treatments helped boost buying in relatively riskier stocks at the expense of safe havens, including precious metals. The US metal and financial markets will also be closed on Thursday in celebration of Thanksgiving.

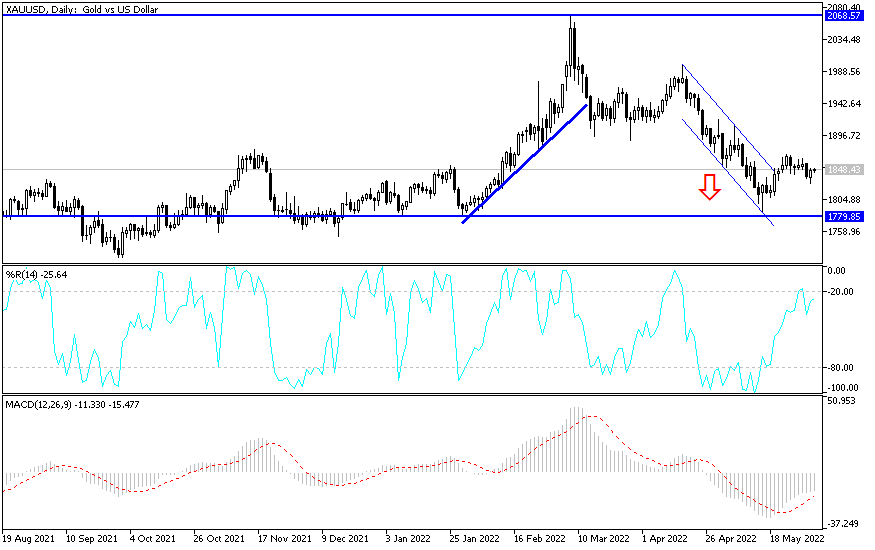

Gold prices dropped for the second week in a row as traders reassessed their expectations in global markets, and main macro drivers in the economy continue to transform rapidly. The price of gold has decreased by more than 4.5% from its highs of $1965.55 an ounce that were tested on the ninth of November and, despite the recent decline, the price of XAU/USD is still 20% higher since the beginning of 2020. Also, the recent letter between the US Treasury and the US Federal Reserve has led to an injection of risk aversion bids into the yellow metal until the end of this week, which could lead to an eventual price hike.

In a letter sent to the US Federal Reserve, US Treasury Secretary Stephen Mnuchin requested a refund of $430 billion in unspent CARES Act funds from an emergency lending facility that will expire by the end of 2020. The Federal Reserve confirms the necessity of continuing the facilities as support.

In general, it is clear that the economic outlook is still subject to coronavirus developments. Although approval for the vaccine appears imminent, distribution will likely take more time. The deteriorating situation of COVID-19 leaves much uncertainty for traders to ponder. The decline in the price of gold will be an opportunity for gold investors to buy it from each declining level, and the closest support levels for gold are currently at 1833, 1820 and 1800, respectively. On the upside, the 1900 psychological resistance will remain the most important for the return of bulls' control of performance.

In addition to the extent of investor’s risk appetite, gold will be affected today by the announcement of the German economic growth rate, then the IFO reading and, during the US session, the US Consumer Confidence Index reading will be announced.