Instability and cautious anticipation is what characterizes the gold performance in recent trading sessions, as the yellow metal awaits the final results of the US presidential elections. Since the beginning of the week’s trading, the price of gold has stabilized between $1916 an ounce and $1882 an ounce and stabilized around $1908 at the time of this writing. It looks like the US election results will likely give a divided verdict, with Democrat Joe Biden getting a nod as president while the Republicans appear poised to dominate the Senate.

December silver futures closed down $0.441 at $23.893 an ounce, while December copper futures were steady at $3.1070 a pound, an increase of $0.0145 from the previous close.

On the economic side, the US private sector employment increased by much less than expected in October, according to a report issued by the payroll processor ADP. According to the survey, private sector employment increased by 365,000 jobs in October after rising by an upward revision of 753,000 jobs in September. Economists had expected an increase in private sector employment by 650,000 jobs compared to the 749,000 jump that was originally reported for the previous month.

A report by the US Commerce Department showed that the US trade deficit narrowed to $63.9 billion in September from $67.0 billion in August. Economists had expected the deficit to narrow to 63.8 billion dollars from 67.1 billion dollars originally from the previous month.

Growth in US service sector activity slowed more than expected in October, according to a report from the Institute for Supply Management. The US ISM Services PMI fell to 56.6 in October from 57.8 in September, still above the 50 level reading, indicating growth in the services sector. Economists had expected the index to decline to 57.5.

The volatility of the foreign exchange market and the rest of the global financial markets has increased dramatically over the past 24 hours. It may remain elevated after US President Donald Trump prematurely described himself as the winner of the presidential elections and indicated the possibility of the election entering a protracted legal battle. Therefore, the "safe haven" US dollar was bought heavily in the middle of the week’s trading after Trump told his supporters: “We will win this, as far as I am concerned we already have.” He added that he plans to go to the US Supreme Court and wants to stop all voting. "Frankly, we won this election," he said.

The dollar’s rally came on the heels of the decline it witnessed on Tuesday, when markets were in a position to make a possible “blue wave” outcome. Trump's announcement is unfounded due to the continued counting of simple observations, but it indicates the possibility of the race slipping into a long-term legal battle, which increases the volatility of the markets and gold is not far from it.

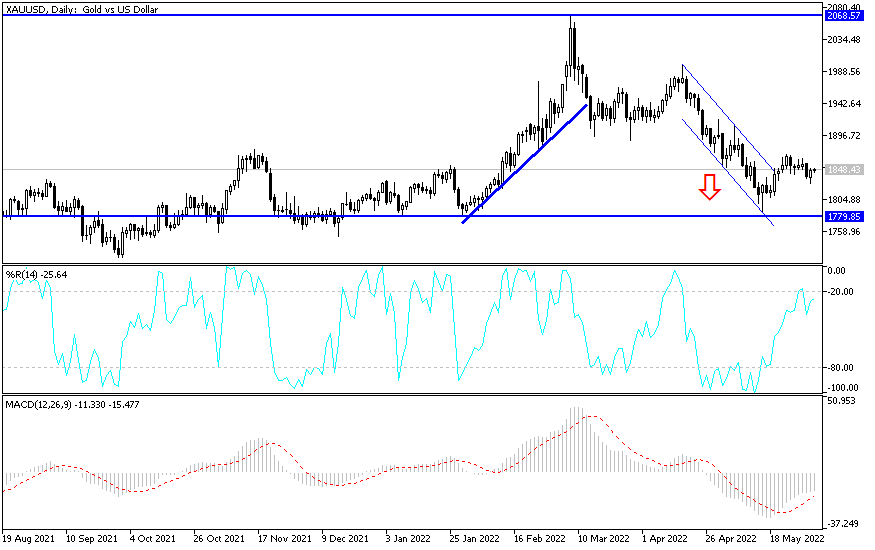

Technical analysis of gold:

As I expected before, the bulls will still have the opportunity to lead the trend as long as the price of gold is stable above the $1900 resistance, and the opportunity will increase further if gold prices move towards the resistance levels at 1917, 1928 and 1955, respectively. On the downside, the 1885 support will remain important for the bears to move towards stronger support levels. At the same time, I still prefer to buy gold from every lower level, whatever the outcome of the US elections. The US Federal Reserve is expected to keep its monetary policy unchanged. Fed administration led by Jerome Powell expects the next US president to give the opportunity to pass more stimulus plans for the US economy.