During yesterday's trading, gold prices fell sharply and recorded their biggest drop in more than seven years. The price of the yellow metal collapsed from $1965 an ounce to $1851 an ounce, its lowest in six weeks. Investors are strongly taking risks as a result of news regarding a possible coronavirus vaccine. The US presidential election results, which showed Democratic Candidate Joe Biden winning, also contributed to the sharp rise in the global stock market.

December gold futures closed down about 5%. December silver futures closed down $1.961 at $23.701 an ounce, while December copper futures were steady at $3.1560 per pound.

Asian, European and US stock markets closed sharply higher. Accordingly, the Dow Jones is now up over 4.7% and the S&P 500 is nearly 3% higher, while the NASDAQ index of tech stocks is up by modest gains of 0.5%.

Pfizer Inc. and BioNTech SE announced that the first set of results from the phase 3 trial of a COVID-19 vaccine provide preliminary evidence of the vaccine’s ability to prevent COVID-19. The results were based on the first interim efficacy analysis conducted on November 8, 2020 by an independent external committee to monitor data from the phase 3 clinical study. The committee did not report any serious safety concerns.

Meanwhile, coronavirus cases have increased in many countries around the world, as several states across the United States have reported spikes in new infections with the coronavirus, and there are concerns that the number of victims will rise in the next two months. For his part, US President-elect Joe Biden announced the members of the Coronavirus Task Force. "Dealing with the coronavirus pandemic, COVID-19, is one of the most important battles that our administration will face, and I will face the crisis with science and experts," he said.

Before performing on Monday, silver and gold prices had avoided the price explosions during the past few trading sessions. Both silver and gold gained 7.5% and 3.6%, respectively, month after month with announcements largely reflecting the significant drop in the US dollar index, DXY. Moreover, the sharp drop in the S&P 500 after the US presidential election is also likely to improve volatility conditions and possibly help gold prices rise again.

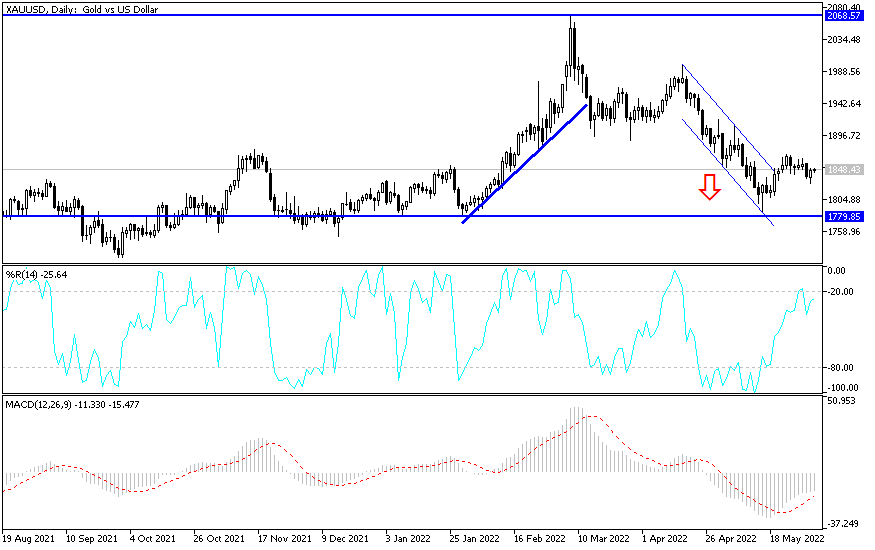

Technical analysis of gold:

Recent downward correction of the gold price may be an opportunity for gold investors to think about buying gold again. We see that the support levels at $1855, $1840 and $1820, respectively, are the most appropriate in which to invest and to then wait for the opportunity to rebound again. That will be possible, as the market has priced everything around the US presidential elections and the announcement of coronavirus vaccines, and implementing everything that contributed to this optimism may take time. On the upside, I still see that testing the psychological resistance level at $1900 an ounce is very important for the bulls in controlling gold price performance again.

Today, the price of gold will be affected by the extent of investor’s risk appetite, along with the performance of the US dollar, the announcement of the German ZEW reading, UK employment and wages figures, and upcoming statements by the monetary policy officials from the US Federal Reserve.