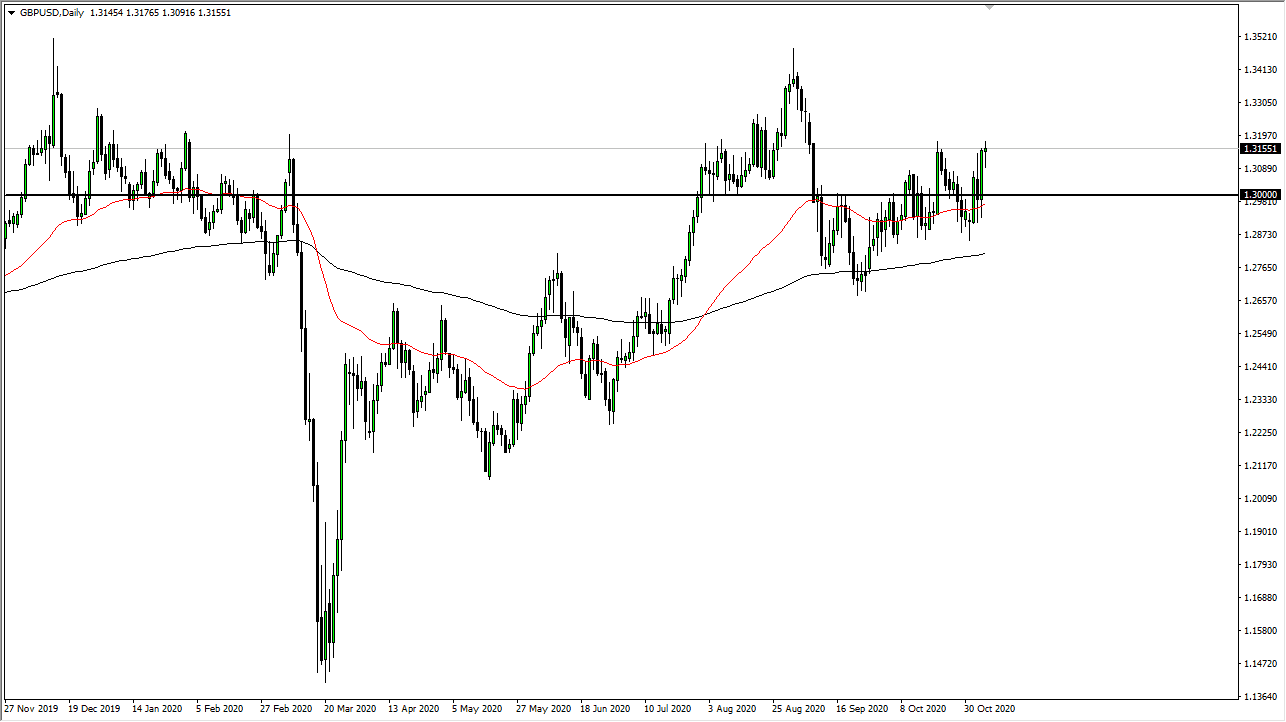

The British pound has fluctuated during the course of the trading session on Friday, as the markets continue to watch several things at once. This is not giving us much help, because the British pound continues to be noisy. We are looking at the 1.32 level area, and it is an area that has been resistance previously. The question now is: will this end up being a “double top?”

Looking at this chart, the 50-day EMA sits underneath the Thursday candlestick, showing signs of extreme supported by the way the markets have been playing lately. This is a market that is trying to form support at the 1.30 level as well, but we have sliced through it so many times that it is going to be difficult to make that the case.

If we can break above the top of the candlestick during the trading session on Friday, then it opens up the possibility of going towards the 1.34 level, which is an area in which we have seen some selling pressure. If we break down below the bottom of the candlestick, then it is a simple pullback. Either way, I am not looking to short the British pound, even if I do want to buy the US dollar. If I am looking to buy the US dollar, then I would probably buy it against the Euro or perhaps the Australian dollar. The British pound is so noisy and so resilient that is difficult to get aggressively short of it. The market continues to grind in general, so it is only a matter of time before buyers return on dips. With this, we are simply going to kick it around until we decide whether or not Brexit will be solved.

Once we get past the noise in the United States, then it will become about Brexit again. That is the never ending problem with the British pound, but since the market decides that the British pound wants to go higher over the longer term, then you have to treat this as a one-way trade. We are just too far to the upside to start buying.