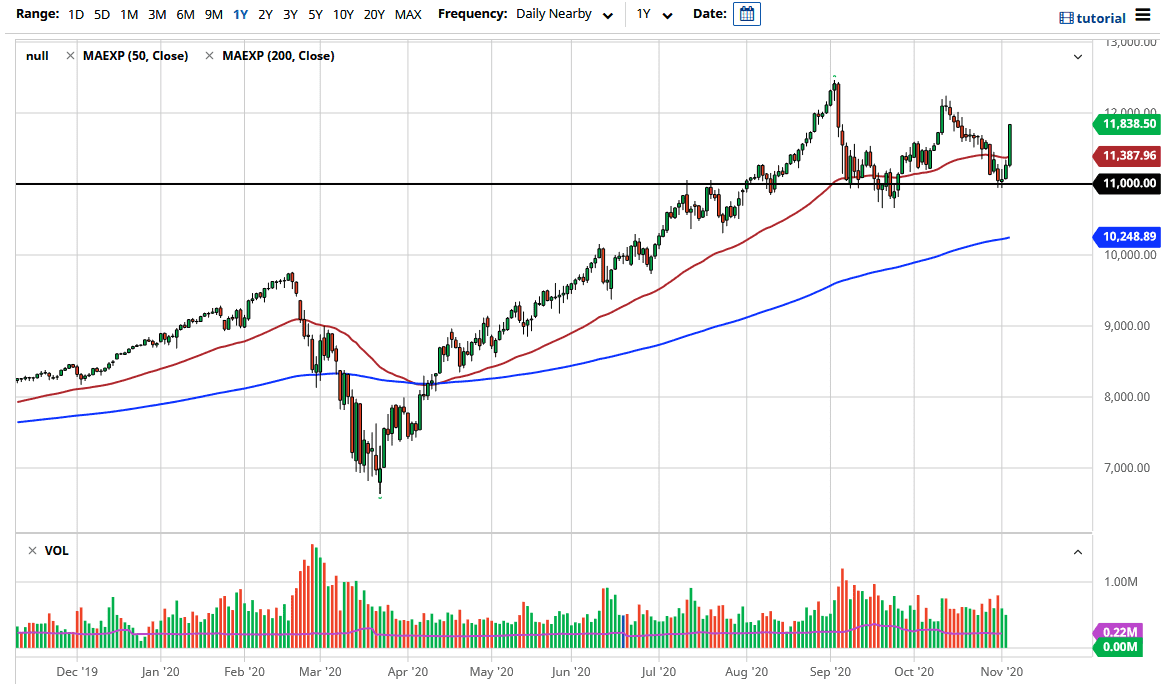

The NASDAQ 100 has rallied significantly during the trading session on Wednesday, slicing above the 11,800 level. More impressively, we have broken higher and closed towards the top of the candlestick. The 12,000 level should be significant resistance, and if we can break above the most recent high, then we could continue to go much higher. However, it is the same handful of stocks that have driven it higher, so the question now becomes whether or not it is truly healthy?

We are starting to look at the possibility of further lockdowns under a Biden administration, which would drive up the safety trade, such as “work from home” companies. Nonetheless, the 50-day EMA underneath at the 11,387 level should be, just as the 11,000 level would be as well. Short-term pullbacks will more than likely find plenty of buyers, and we are simply looking at a market that is trying to test the top of the range that we have been in, so we are still looking at potential action. However, if we do break above the 12,250 level, then we could be looking at a move for another thousand points or so. We will not short indices anytime soon, since the indices are heavily weighted towards a few particular stocks.

I have no interest in shorting this market, and if we start to break down significantly, it is likely that we will be better off buying the US dollar than anything else. It will be interesting to see what happens next, with the likelihood of exhaustion above. If you are patient enough you should get an opportunity to pick up a little bit of value, as the market only goes in one direction given enough time. The question now is whether or not we get an opportunity to play it based on stimulus, because the makeup of the US government will have a lot to do with that. Wall Street was hoping for something massive; I do not think they are going to get it, at least not anytime soon.