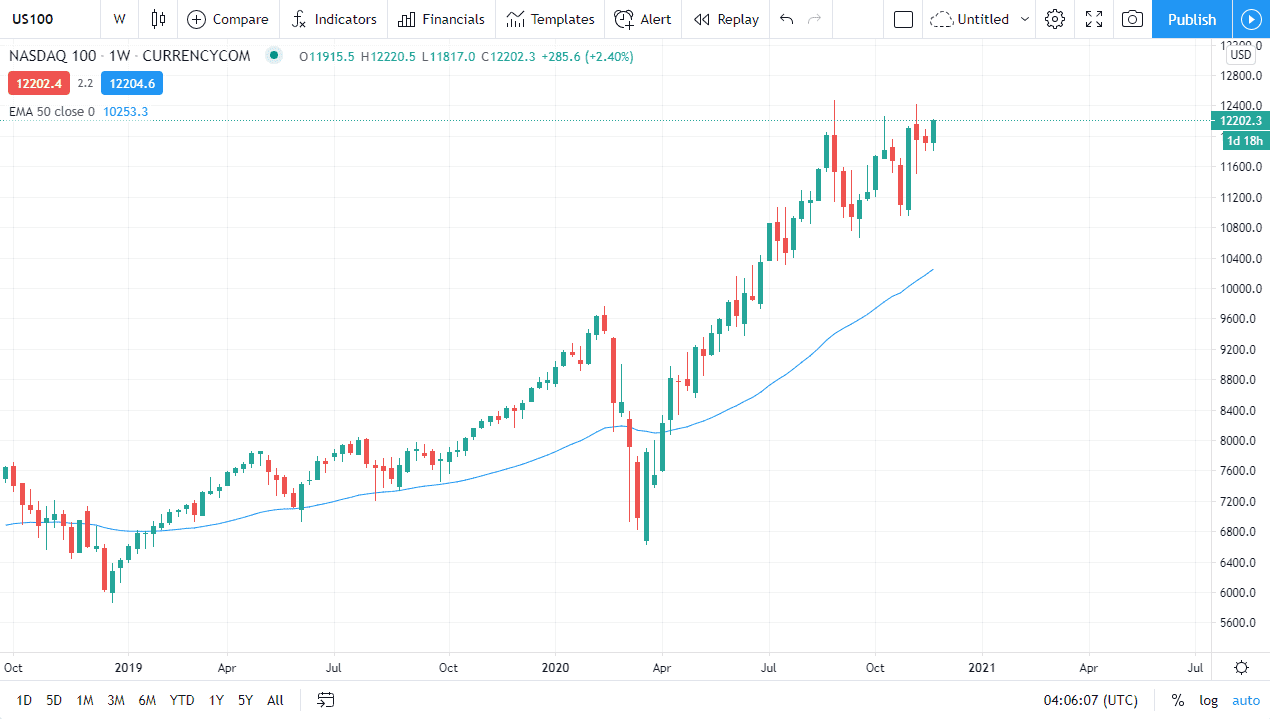

The NASDAQ 100 has been somewhat range-bound over the last couple of months, but as we start to look towards December, it is very likely that we will see an attempt to break out. The reason I say this is that the lows in the recent consolidation continue to rise, especially as we got past the second week of November. We are starting to see a much more aggressive move to the upside and, with a coronavirus vaccine on the way, we will continue to see buyers jump in and try to front run the economic recovery.

The NASDAQ 100 is in a particularly enviable spot when it comes to other assets because it still has room to run on the “work-from-home trade”, as a lot of the major players in heavily weighted stocks in this index include Netflix, Microsoft, Facebook, and the like. This should drive up revenues for all of these companies. Even though we are starting to imagine a post-coronavirus world, the reality is that there are several months of lockdowns in various parts around the world between now and then. That helps most of the companies in this index.

However, most of the companies in this index will continue to see strong growth because the economy on the whole should grow. Keep in mind that the growth a lot of these companies have enjoyed during the pandemic has changed the workplace forever. A lot of companies out there are starting to use more “work-from-home products”, which will directly influence this index as well. If the market can break above the 12,500 level it will start to take off to the upside yet again. An argument can be made for a measured move of the market going to 14,000 based on the consolidation area from which we are breaking out To the downside, plenty of support is to be found at various levels, all the way down to the 11,000 handle quite easily. With all the US dollar selling out there, that could also be a catalyst to go higher. Buying the dips should continue to work into the new year.