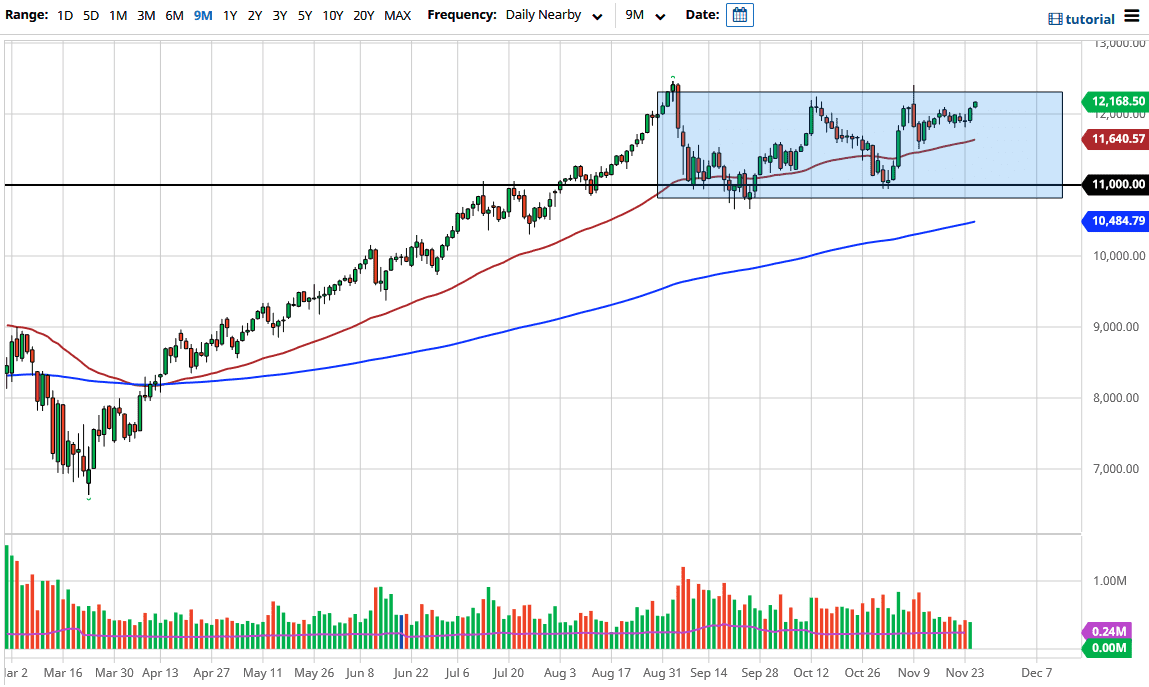

The NASDAQ 100 gapped higher to kick off the trading session on Monday and then continued to go higher yet. This is a market that continues to try to break out and, as we have major liquidity measures out there, we will eventually break above the recent highs. In the meantime, short-term pullbacks will continue to offer buying opportunities, especially near the 12,000 level and the 50-day EMA underneath that.

The NASDAQ 100 is driven by a handful of stocks as most indices are, and in the NASDAQ 100 it tends to be the usual “work-from-home” companies. It is therefore likely that we will continue to see a handful of companies pushing this index higher. Eventually, we will reach the highs again, so I like the idea of buying short-term pullbacks as we will see a scenario in which liquidity overtakes everything.

Even though the work-from-home stocks could suffer from a vaccine opening up the global economy, the reality is that between now and then we have many economies locking down, so we will see these stocks continue to drive things higher. With the liquidity that we see, it is almost impossible for stocks to fall, because Wall Street will pump all of the money every time they hear that there are extraordinarily loose monetary measures being either taken or considered. The Fed meeting minutes came out during the course of the day, suggesting that the Federal Reserve is willing to do whatever it takes - which is what people would expect - but it just reinforces the idea that the Federal Reserve is going to make sure that nobody loses money for any significant amount of time. Because of this, I have no scenario in which I'm willing to short this market; not only do we have the aforementioned support levels, but there is a massive “floor the market” near the 11,000 handle as well. Yes, the market needs to pull back in order to offer value, but I am not sure that anybody is paying attention.