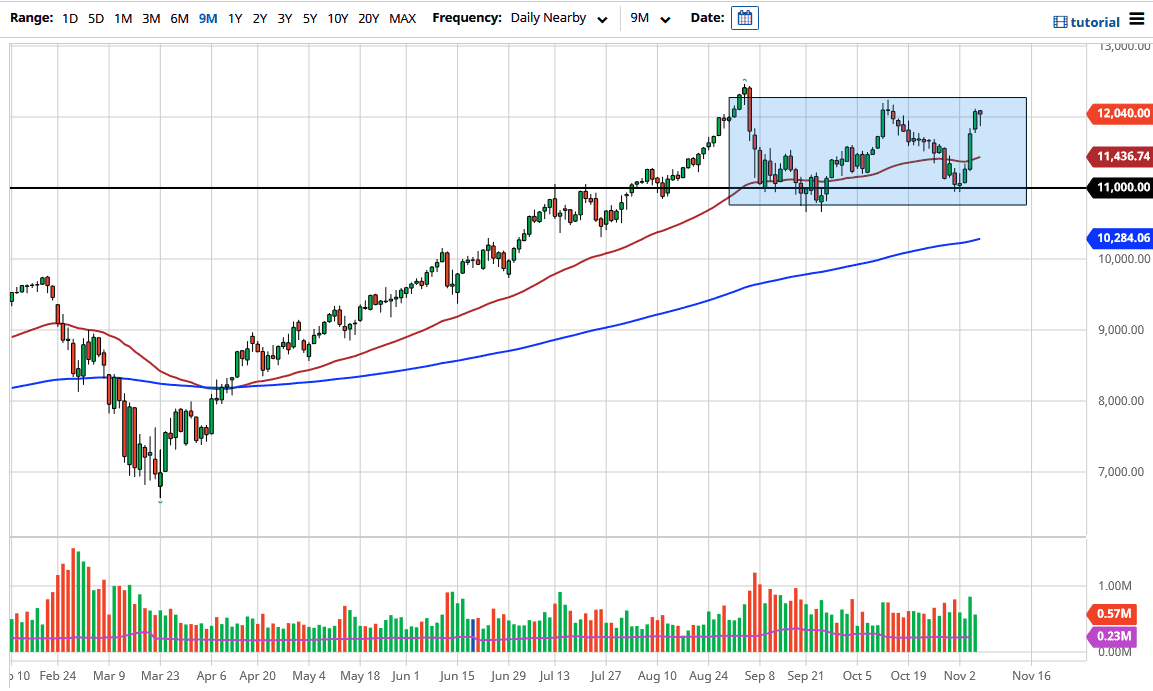

The NASDAQ 100 has pulled back during the trading session on Friday, only to turn around and show signs of support again. The market has shown itself to be resilient as we have bounced, but we are fighting a significant resistance barrier. The market breaking out above the recent highs could show this market ready to go higher, but this is a market that will continue to hear a lot of noisy trading. A pullback right now is simply a value play that we can take advantage of.

The 50-day EMA down at the 11,400 level should continue to offer plenty of support, especially if we get there quickly. The market is hoping for large amounts of stimulus, and if we get back, markets might continue to go much higher. The market has tied itself to the idea of the cheap money, and we can continue to see bullish pressure based upon that alone. The NASDAQ 100 is driven by a handful of stocks that everybody seems to buy, and as long as Netflix, Apple, Microsoft, and a few others rally, this market will do the same.

To the downside, the 11,000 level underneath is essentially the floor at the moment. But it is now likely that we will see value hunters coming into the marketplace, since the area between the 50-day EMA and the 200-day EMA continues to show plenty of support. The market is likely to see plenty of pushing to the upside, reaching towards the 13,000 level and beyond. This market continues to be noisy, but I have no interest in trying to catch money to the downside, because if the NASDAQ 100 breaks down, it is likely that we will find enough value hundreds to jump in and get involved. Looking at this chart, the question now is whether or not the Friday candlestick becomes a hammer that shows a breakout, or does it become a “hanging man?” We should know in the next day or two.