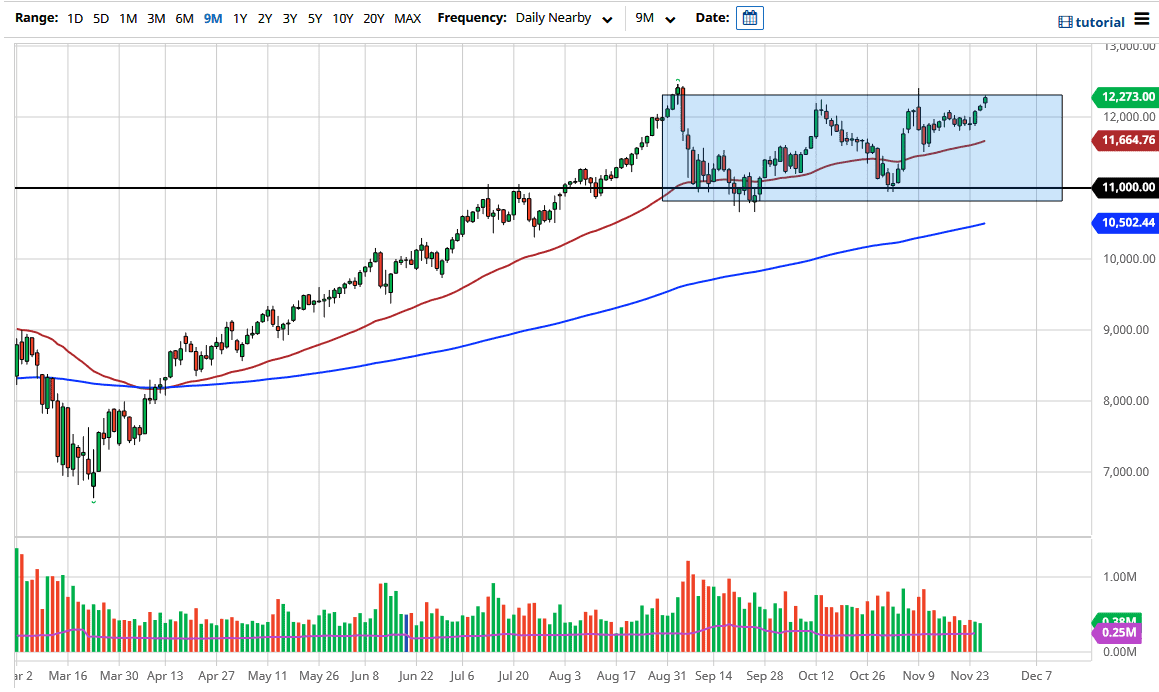

The NASDAQ 100 pulled back during the trading session on Friday, but then rallied again to reach towards the 12,275 level, which was the most recent area for highs. It looks as if we are trying to get to the upside and take advantage of what has been significant momentum. As you can see, the market has pulled back to the 50-day EMA, and then went sideways for about two weeks. After that, we have seen the NASDAQ 100 take off yet again. We are going to try to break out to a fresh, new high, so pullbacks will continue to attract attention.

The NASDAQ 100 is a particularly interesting index to pay attention to now, because the liquidity measures by the Federal Reserve are lifting stocks in general, including the NASDAQ 100. Furthermore, the biggest drivers of the NASDAQ 100 continue to be the “work-from-home” companies, which help the NASDAQ 100 in general. Some of those are the biggest growers out there in the world, so hot money goes into the NASDAQ 100. Now that we have the US dollar losing steam, people are starting to step out on the risk spectrum and buy some of the companies in the NASDAQ 100 that are not the heaviest weighted ones, for once.

If we do break out to the upside, then it is likely that the market will go looking towards the 13,000 level above, and then possibly much higher. There could be an argument made for a measured move to 14,000 based on the previous rectangle, and there is also the “Santa Claus rally” that a lot of traders look for this time of year. Because of that, what we are seeing here is yet another attempt to take off to the upside, but I would also point out the fact that the most recent low was much higher than the one before it. This is a common pattern: a consolidation rectangle that does not quite make it to the bottom of the last time before we finally have the momentum to take off.