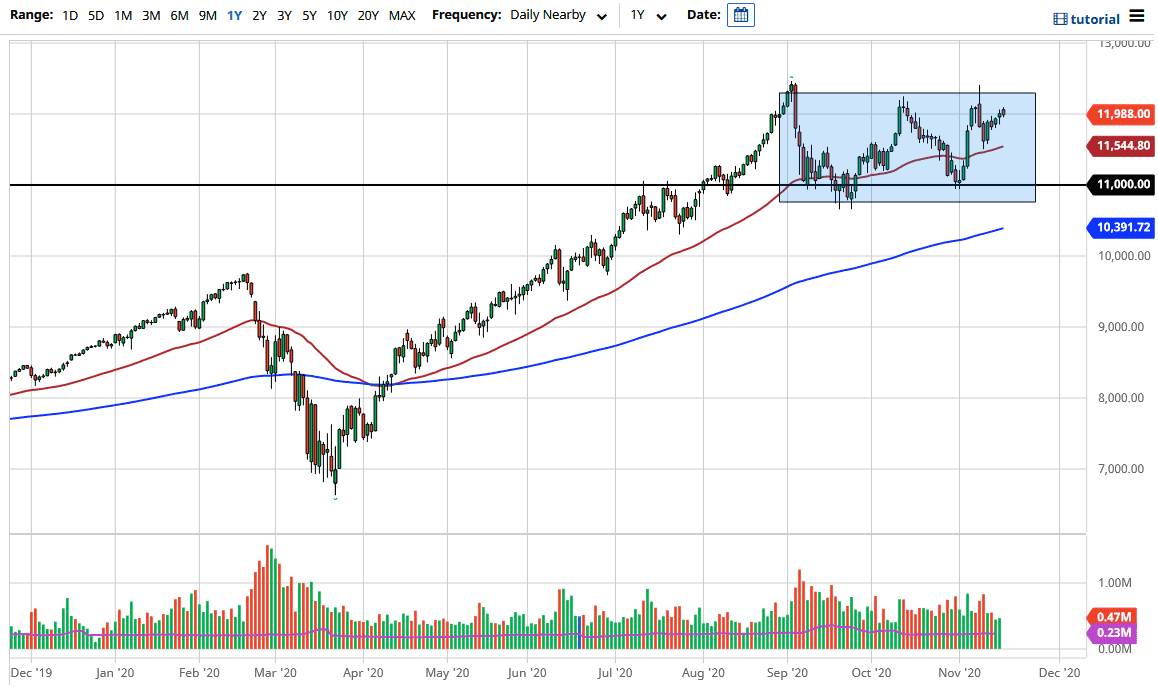

The NASDAQ 100 initially tried to rally during the trading session on Tuesday but continues to find resistance just above. The 12,000 level seems to be too much for the market to continue to go higher, so we will likely see a pullback. But there is plenty of support underneath to keep this market afloat. Furthermore, as you know by now, the people on Wall Street never short the market for any significant amount of time. The 50-day EMA offered support this last time when we pulled back, and the most recent low is higher than the previous one. It looks like we are trying to break out, but we have a lot of work to do.

Looking at this chart, you can see that there have been buyers every time this market has pulled back, and I do not think that is going to change anytime soon. I have no interest in shorting the market, and the Federal Reserve will do everything it can to flood the market with liquidity. If that is going to be the case, then we will continue to see the NASDAQ 100 attract money. Beyond all of that, we need to talk about the coronavirus as well.

Coronavirus figures in the United States have been rising, and even though there is good news coming out about vaccines, the reality is that the caseload around the United States - and rest of the world, for that matter - is growing. This means that a lot of the “work from home” stocks are going to continue to attract attention. It looks as if the NASDAQ 100 is taking advantage of that, as some of the biggest stocks in that general vicinity of the world drive up this index. This is a market that continues to see plenty of buyers underneath, so it is likely that dips will continue to be the best way to get involved in the market. But we would need to clear the 12,500 level for that.