The NASDAQ 100 has pulled back just a bit during the trading session on Wednesday, as it looks like the 12,000 level is going to be expensive. This is no surprise, considering that the market has completely refused to acknowledge anything along the lines of gravity. It is likely that the market will continue to fluctuate, but there are plenty of support levels underneath that will keep this market somewhat afloat.

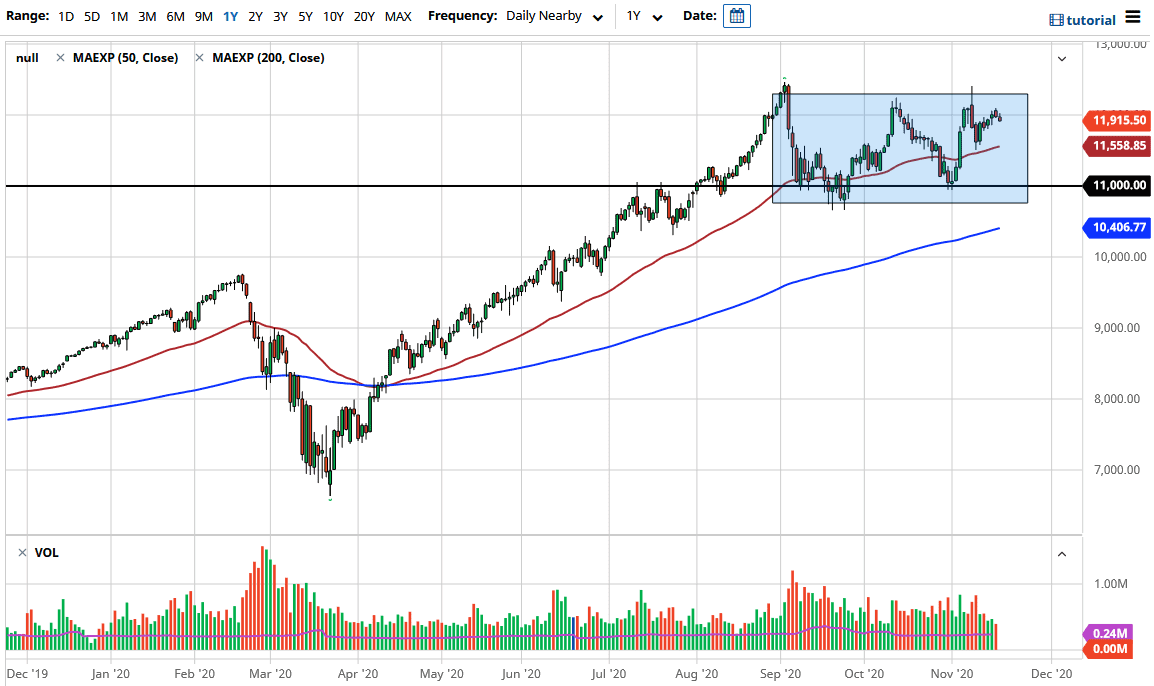

The first area that I am paying attention to is the 50-day EMA, which is currently sitting at the 11,558 level. That area should attract a lot of attention. If we were to slice through, then we could go all the way down to the 11,000 handle. However, if we get a supportive candlestick in that area, it offers a nice buying opportunity in a market that seems destined to go higher, as Wall Street cheers the fact that they are getting cheap money again coming out of the Federal Reserve.

You should also pay attention to the fact that the market is starting to look at the possibility of more lockdowns, so the “work from home stocks” could suddenly come back into favor and then the NASDAQ 100 would get a boost. However, if we are starting to focus on the idea that there are coronavirus vaccines coming in about a year, then buyers will be excited and start to try to price things based upon earnings of next year or whatever the case might be. This is a market that has recently made a “higher low” which is what I am watching the most. It is only a matter of time before we get a buying opportunity, so we should be paying close attention to the support of candlesticks underneath as they appear. I have no interest in shorting this market; indices are not built to fall for any significant amount of time as they are not equally weighted. It is almost always a “buy on the dips” scenario.