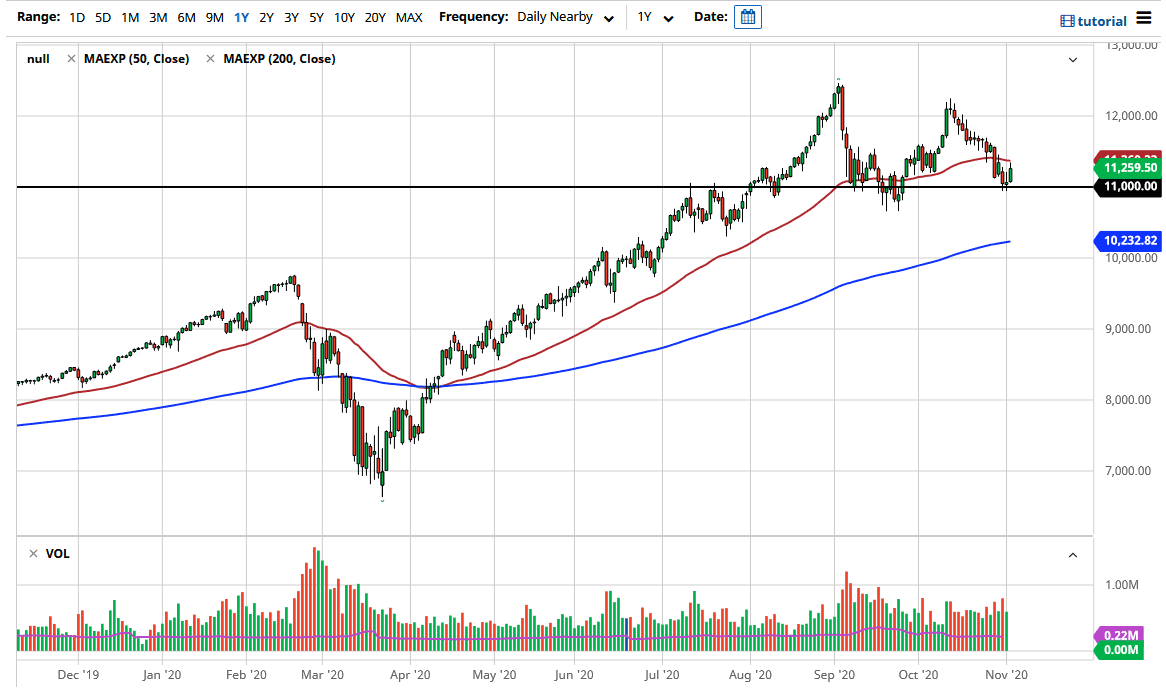

The NASDAQ 100 had a relatively strong session during the trading session on Tuesday, as we have bounced from the crucial 11,000 level. This is an area that will attract attention by itself, not to mention that it has been previous support. However, it is worth noting that we did fail at the 50-day EMA, so it makes sense that we will continue to see choppiness. Traders will not be confident the later the day goes on without election results in the United States. It is essentially a wait-and-see moment.

Traders are banking on a quick outcome to the election, and hopefully a scenario in which stimulus will be easy to pass. They are likely going to be disappointed on one level or another. To imagine that anything short of a complete Democratic sweep would lead to a cooperative US government is naïve to say the least. Furthermore, as we saw four years ago, polls tend to be wrong. Remember, this is not just about who becomes president of the United States for the next four years, but also who controls the US Senate.

The market is likely to go higher eventually, but we are going to need clarity. If not, then it is possible that we will break down. I think the 200-day EMA will be massive support as well, so given enough time I am more than willing to buy dips.

Although I know many retail traders are desperate to press many buttons in a short amount of time due to the potential volatility, the real money is going to be made over the longer term, based upon an obvious daily candlestick. My suspicion is that the market will suddenly make up its mind as to where it wants to go. Trying to anticipate it is a surefire recipe for potential disaster, so that is something that you should keep in mind as well.