NASDAQ 100 traders had a short but choppy range during the trading session on Monday, as traders continue to look at the 12,000 level as a potential barrier. The 12,000 level is a large, round, psychologically significant figure, and the top of the overall range that we have been in. We will eventually try to break out above there, but until then, it looks like we are probably going to be killing time.

The candlestick for the session on Monday seems to be a perfect microcosm of what we are going to see over the next couple of days. After all, the market is dealing with the the Thanksgiving holiday on Thursday, so there is not going to be much volume for the next couple of days. Traders will be worried more about Thanksgiving than trading a dead market, and we are at the top of the overall range. I think pullbacks are likely to be coming, but those pullbacks should be thought of as potential buying opportunities.

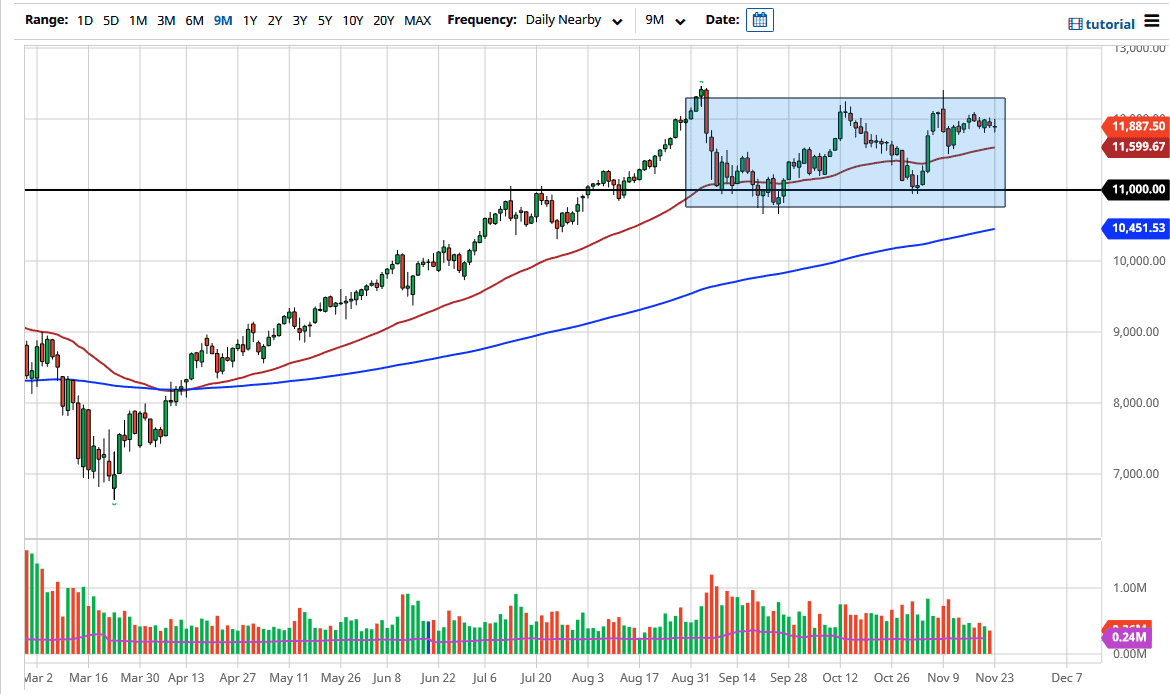

The 50-day EMA underneath is at the 11,600 level, and there will be a lot of interest in that area. Looking at the chart, I believe that area should offer a significant amount of support, as it is a widely followed longer-term technical indicator. Underneath there, the 11,000 level is very likely to be the support. Dips will be thought of as value as everybody seems to believe there is always a “Fed put" underneath stocks in general.

If we do get the occasional pullback, many people who have missed this move to the upside over the last couple of weeks will be more than willing to jump in. Alternatively, if we can break out to a fresh, new high, then it is likely that we will go looking towards the 13,000 level after that. We are in an uptrend, and there is no point in fighting it. However, we are getting very close to the slowest time of the year, so it is likely that we will continue this choppy behavior more than anything else.