The NASDAQ 100 has broken down significantly during the trading session on Tuesday, reaching down towards the 50-day EMA again. This is a technical indicator that people pay attention to, so we should take advantage of it for support. This market continues to see the bullish case more than the bearish one.

Much of what is going on in the NASDAQ 100 is that they are starting to sell off the “stay-at-home stocks”, which is a major influence of the overall NASDAQ 100. If we can continue to go higher - and I do think we will - it is going to be based on multiple reasons, not just coronavirus. The stimulus that may come could also drive stocks higher, but it appears that Wall Street is piling into some of the recovery stocks more than anything else, which favors industrials in the short term.

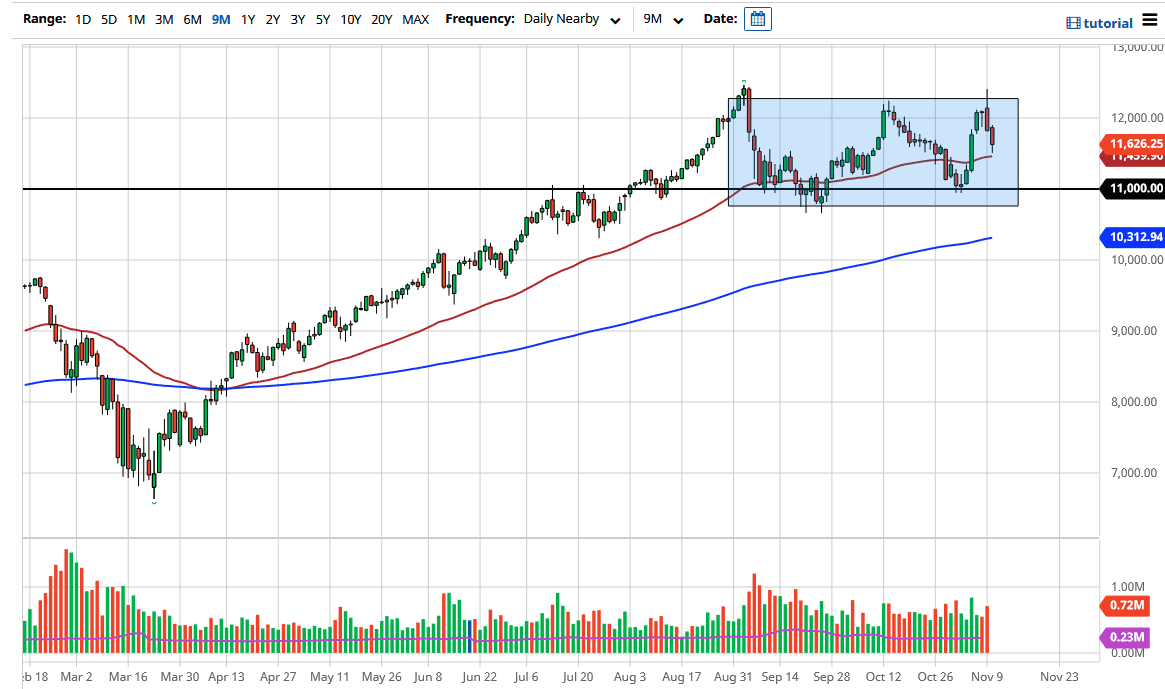

Looking at the larger context of the market, it appears that the 12,500 level above is resistance, just as the 11,000 area underneath is support. In general, this market continues to see buyers on dips, and we also have the 200-day EMA starting to race towards the bottom of the range that we have been testing. The fact that we bounce from the 50-day EMA during the trading session is a good sign, although we could have more of a pullback ahead of us. However, if we get a supportive candlestick, we would be looking to buy this market on an attempted break out to the upside. The Wall Street mentality will continue to jump into this market and take advantage of any reason to go long. People do not short stocks for any length of time, and Wall Street is always looking for the next positive narrative. We also have the coronavirus vaccine now, which suggests that the economy should take off to the upside yet again. Wall Street is finding multiple reasons to buy stocks, as they typically will do. The usual “stay-at-home stocks” are also some of the ones that people will be running towards in a couple of days.