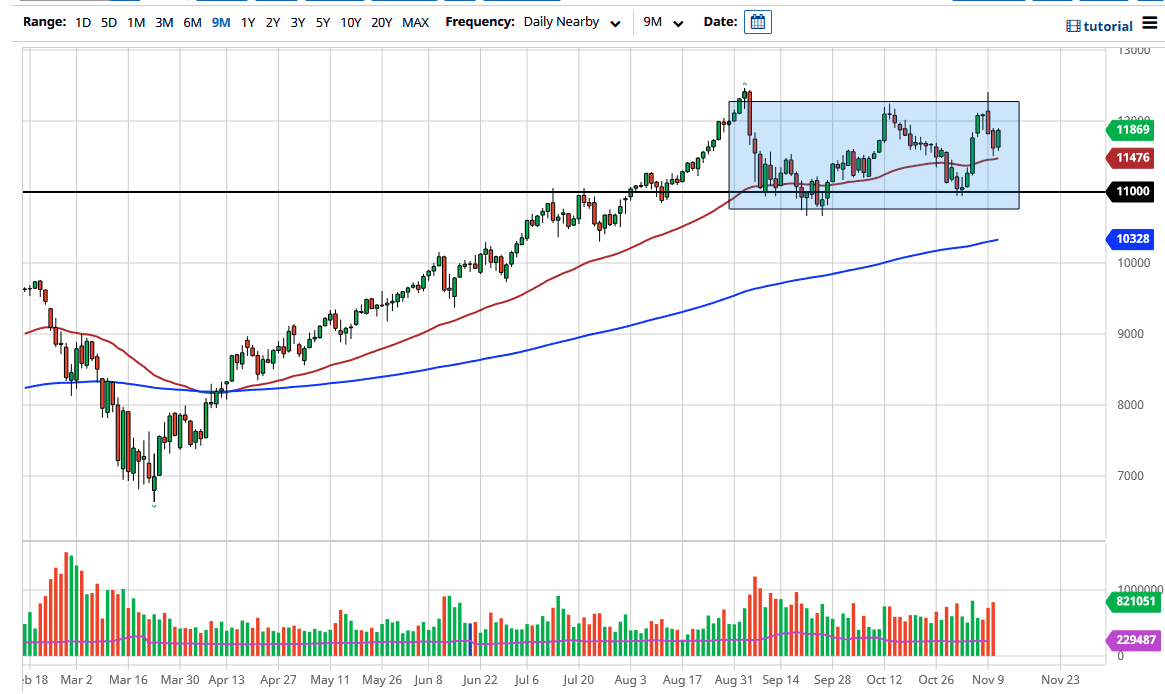

The NASDAQ 100 rallied during the trading session on Wednesday, as the 50-day EMA looks supportive. This market should continue to be bullish, and now that the coronavirus numbers are starting to increase again, people are returning to look at the “stay-at-home stocks”. It is difficult to imagine that the NASDAQ 100 will fall for any significant amount of time, but there are so many moving pieces that people may start to look at the major technology stocks as safety trade again.

The 50-day EMA offers a little support, but the 11,000 level underneath there will be even more crucial, where the market is paying attention to the 200-day EMA, which is a longer-term trend type of indicator. This market will continue to see the idea of a “buy on the dips” situation. The market breaking above the top of the candlestick from Monday could open the door for a move to the 13,000 level, but it is unlikely to happen in the short term. However, I am more than willing to take that trade if we do get there.

We will see a lot of choppiness and negativity, and it is likely that we will continue to see volatility being the main stay in this market. The NASDAQ 100 has been the darling of Wall Street for a while, so it should not be written off so quickly. Looking at this, I do believe that on short-term charts that pull back you will see support of candlesticks that allow people to go long again. That is my plan: buying dips in the NASDAQ 100 as it continues to grind higher over the longer term. This is an index that is comprised of all the favorites of Wall Street, so it would take a lot to knock it down. Because it is not an equal-weighted index, I almost never short the NASDAQ 100 for anything more than a quick scalp.