The NASDAQ 100 initially spiked during the trading session on Monday, but after Pfizer announced that they had a coronavirus vaccine with over 90% efficacy, traders began dumping some of the biggest “work from home” stocks. This includes some of the biggest parts of the NASDAQ 100, so the market got hammered. The NASDAQ 100 was the worst performer of all indices in the United States. We could well continue to drop from here and go looking towards the 50-day EMA rather quickly.

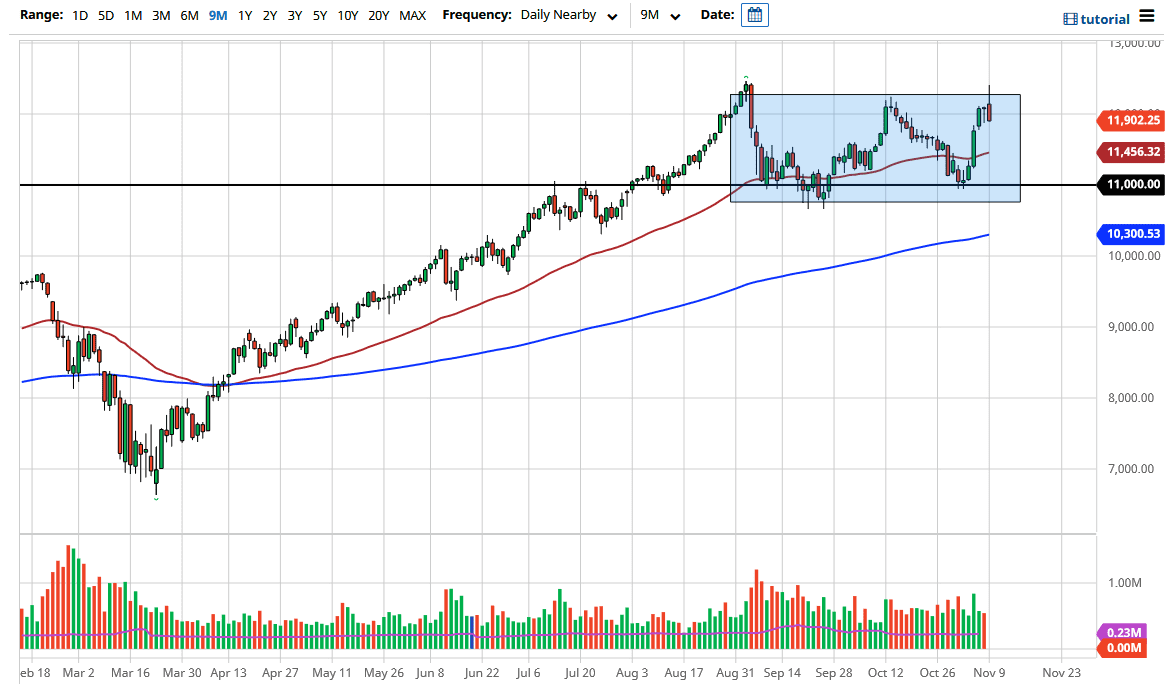

I am not calling for a new bear market, but we are seeing a lot of people rotate out of certain stocks into others. Should that continue, we will see this index drop further and perhaps underperform other indices in the United States. It is best to wait for a buying opportunity underneath, based on a daily candlestick. The 11,450 level is where the 50-day EMA currently sits, so that is the first place I am looking for a buying opportunity. The next support level would be the 11,000 handle, which is a large, round and psychologically significant figure, and where we had bounced previously.

We are at the top of an overall consolidation range, so we should see a pullback from here. This is a continuation of what we have seen for some time, so it is not a huge surprise to see that we found sellers anyway. It does not matter if you are a fundamental trader or a technical trader; you had reasons to be short of the market during the day. I do not have interest in trying to sell this market right now, and if you simply sit on the sidelines and wait for a buying opportunity, you may do much better. Were we to break down below the 10,750 level, we could see even further aggressive selling.