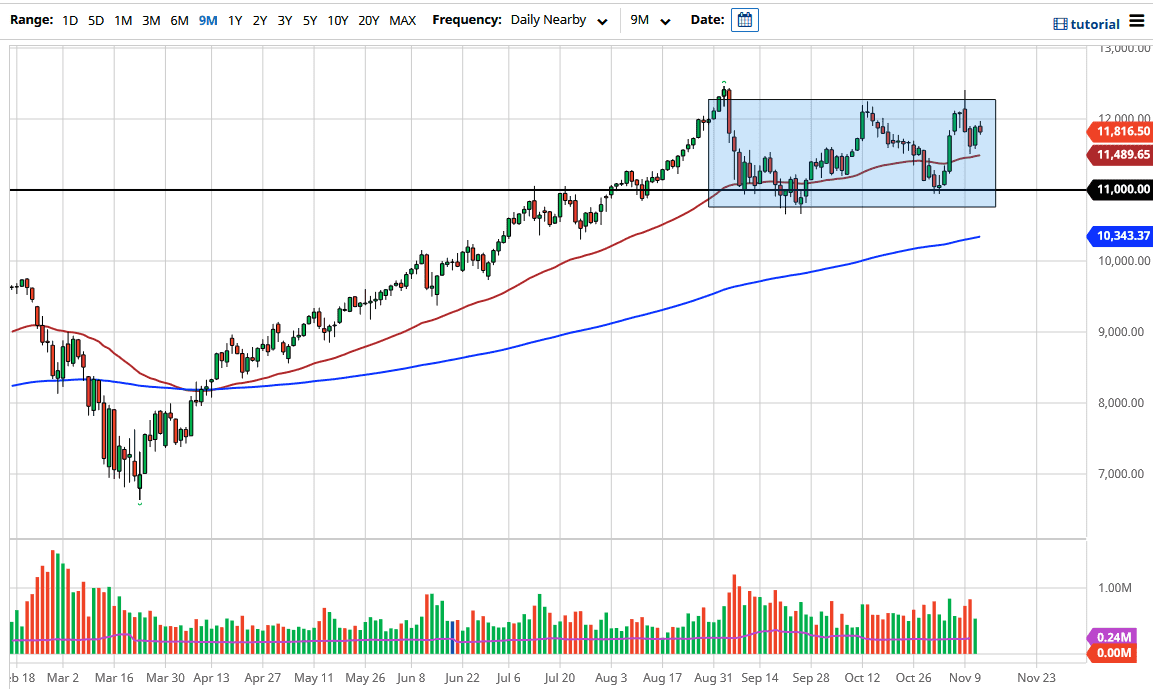

The NASDAQ 100 initially tried to recover during the trading session on Thursday, but later in the day we started to see the 12,000 level offer a lot of resistance. Furthermore, people are starting to take a look at the coronavirus figures, and this could be affecting the markets on the whole. The NASDAQ 100 is comprised of a lot of the household names for the “day at work” environment, so that may have been part of what was sending the market higher earlier in the day. However, we are starting to see a lot of indiscriminate selling, so of course we had to turn right back around.

The question now is whether or not we continue to see noisy trading here, or if the NASDAQ 100 will continue to outperform the S&P 500 as it has done of the last several months. The market has been in a significant consolidation area, between the 12,500 level on the top and the 10,600 level on the bottom. The 50 day EMA sits below at the 11,500 level, and that of course will attract a certain amount of attention in and of itself. With that being said, I think that we are expected to see a lot of noisy trading in this general vicinity. I think Friday could be noisy as well, due to the fact that the fear out there will probably be palpable heading into the weekend.

The market will probably continue to move on the latest coronavirus headlines, or perhaps even the idea of stimulus. At this point time, the market is likely to see noisy trading based upon the latest rumor or headline, and that of course is going to make for a very difficult environment. That being said, I prefer to buy dips in the NASDAQ 100 because no matter what happens, Wall Street seems to find a way to have a positive narrative. This does not mean that the economy is suddenly going to come roaring back, but the reality is that the NASDAQ 100 and the economy have absolutely nothing to do with each other. If Wall Street thinks that it is not going to get cheap money pushed into the economy, the next thing they will do is start selling. It is essentially like a child throwing a temper tantrum when it does not get what it wants.