The NASDAQ 100 rallied nicely during the trading session on Tuesday, as we have broken above the 12,000 level yet again. This is a reflection of the overall bullish pressure that we have seen in stock markets overall, and the Dow Jones Industrial Average even managed to break above the 30,000 level during the day. Because of this, there was a bit of a “knock on effect” when it came to the NASDAQ 100, as everything went straight up in the air.

There is a lot of liquidity out there sloshing around in the system, so people are buying “things” to keep from losing wealth. It is essentially forcing traders to get into the market and go long. I find it interesting that the NASDAQ 100 is struggling, except that most of the reason we have seen the NASDAQ 100 rally significantly is the “stay-at-home stocks”, such as Facebook, Microsoft, Netflix, and the like. The market is starting to get away from that due to the announcements of coronavirus vaccines. This means that people will be going back into the “real world”, which works against some of the highflyers in this market.

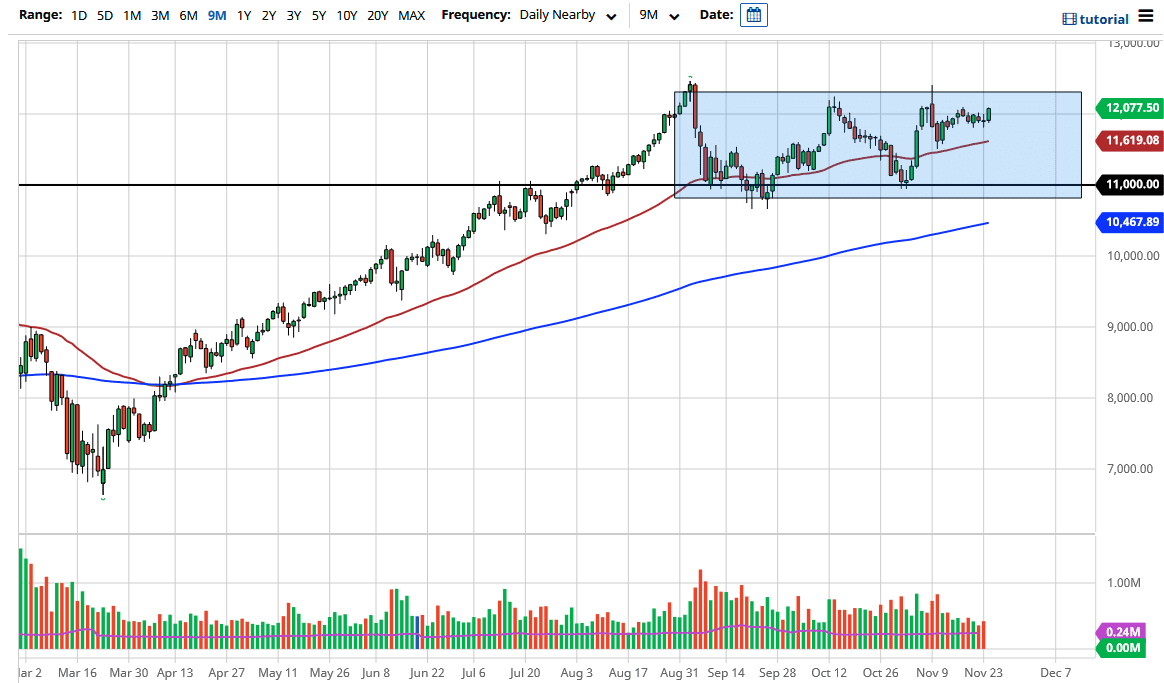

Underneath, I see that the 50-day EMA is starting to reach towards the 11,600 level, which is a round figure that people will be watching. If the market pulls back to that level, there should be plenty of buyers. On the other hand, if we break above the highs from a couple of weeks ago, then it is likely that we will go towards the 13,000 level, possibly even higher than that.

You could make an argument for a descending triangle at this point, and it certainly looks as if the “risk on” move continues to be the one that people are watching. We see this not only in the NASDAQ 100, but in various currency markets, commodity markets, and other indices as well. Pullbacks continue to be buying opportunities, as it seems the only thing people want to do right now is to buy stocks.