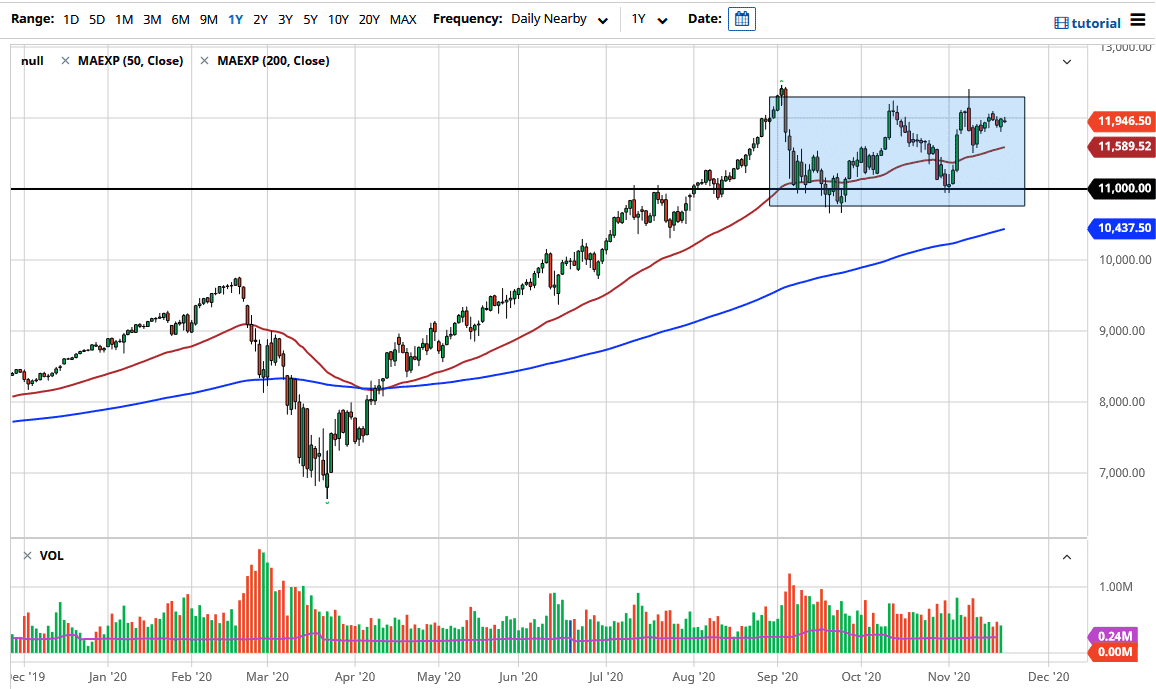

The NASDAQ 100 has done very little during the trading session on Friday, as the whole week has been rather quiet. We are getting close to the top of the overall range that we have been in for a while, which means that we will eventually see a bit of exhaustion set in. I have no interest in trying to short this market because there are plenty of buyers underneath. Eventually, value hunters will come in and try to take advantage of the value that that would entail.

Looking at the chart, there are multiple places in which we would find plenty of interest, not the least of which would be the 50-day EMA. After that, we have the 11,000 level, which I think will attract a lot of attention as well. It is the bottom of the overall range that we have been in, so we will see value hunters there as well. Beyond that, we have the 200-day EMA reaching towards that area, so buyers would be interested in that indicator as well. Remember, stocks in the United States only go up if they are given enough time. (I say that with a bit of cynicism, but it certainly looks as if that could be the case as the Federal Reserve will not allow things to fall for very long.)

This is not to say that you should jump in and buy as soon as you can, but this market is likely to see a “buy on the dips mentality” going forward, as it always has. A lot of the “work at home” stocks continue to be the main drivers of this index, and we are simply trying to digest some of the recent gains. A pullback to the bottom of the overall range certainly makes sense and would be typical of a market that is simply cycling back and forth between support and resistance. Because of this, and because of the fact that we are in an uptrend, I am simply looking to buy at lower levels. Sitting on the sidelines for a couple of days is not a bad idea.