The silver market fluctuated during the trading session on Friday as we continue to see a lot of overall back and forth. All markets were rather choppy during the trading session and it is showing up in silver quite drastically. We reached higher towards the 50-day EMA only to turn around and pull back. This is a market that continues to be very noisy and will remain so in the short term.

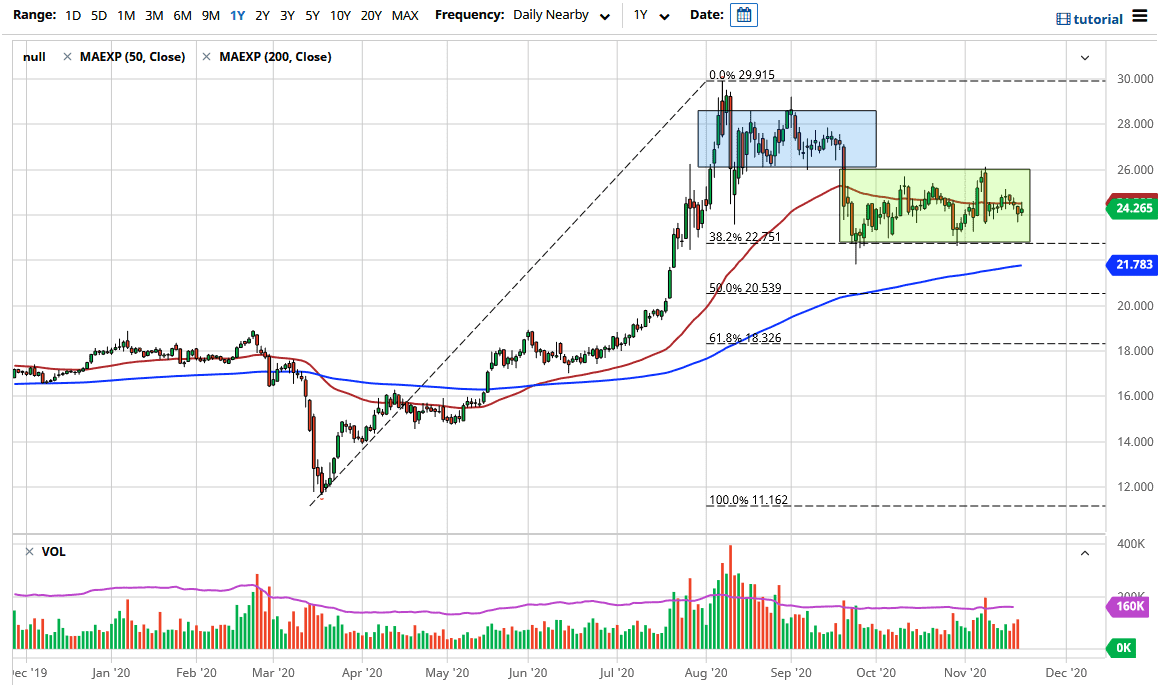

However, I do like silver over the longer term, as central banks around the world continue to flood markets with liquidity and people will be looking for a way to protect wealth. Beyond that, we had a massive rally previously and we need to grind sideways in order to digest gains. That is a lot of what is going on right now, as the 50-day EMA is basically flat. The 200-day EMA sits underneath and is sloping higher; it looks likely that we will see it reach towards the bottom of the green box I have drawn on the chart, so we should see support again. The $22.75 level is where I have the place, and it also coincides quite nicely with the 38.2% Fibonacci retracement level. There are a few reasons to think that the area should hold, so it will be interesting to the buyers out there.

Based on this chart, even if we break down below there, the $20 level would be another area in which we should continue to see support as well. This market tends to work on very technical levels, and $20 is about as big of a round number as it gets. I still believe that buying the dips will be the way to play this market, as the US dollar should continue to suffer losses over the longer term. That is not to say that we are going to go straight up in the air, but you need to be thinking of silver from a longer-term perspective, as more of an investment than anything else. I do believe that we will get a bit of a pullback, but that will more than likely continue to attract value hunters.