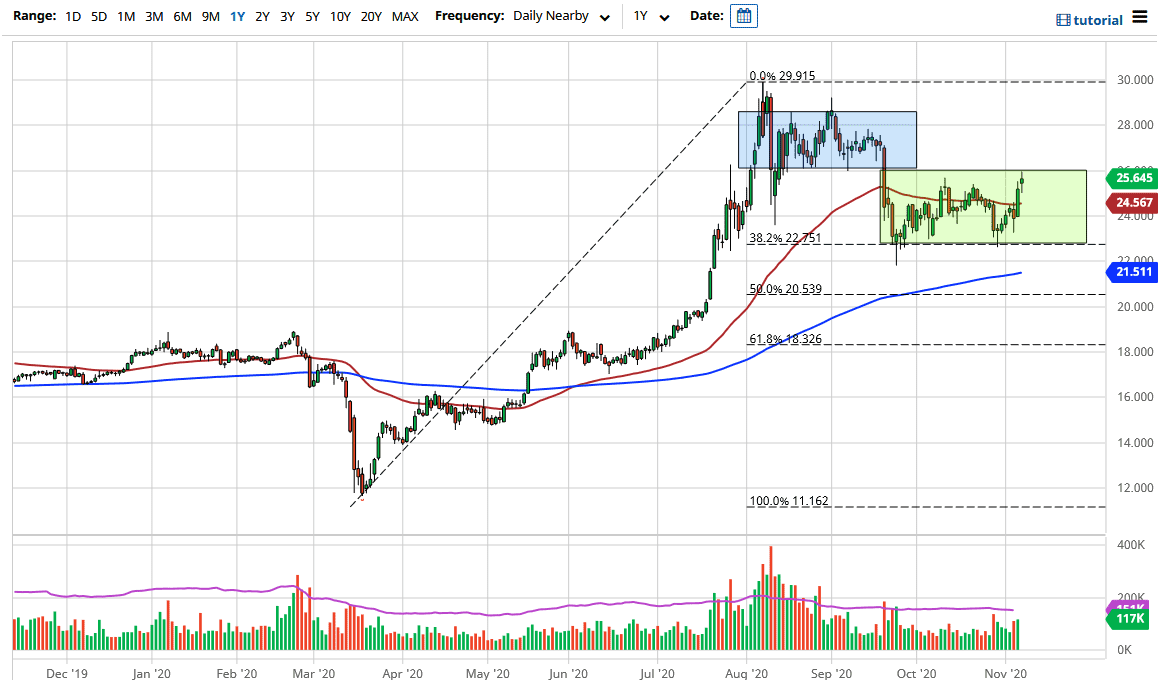

The silver markets gapped during the trading session on Friday, only to fluctuate during the majority of the session. We are at the top of a range in general, and we are not quite ready to go anywhere from here. The candlestick is very neutral, so the market could very well run out of steam here. As we head into the weekend, we could continue to see people be cautious about holding anything while the new cycle will so ugly.

The $26 level was previous support, so it should now be resistance. The fact that we stopped right at that level suggests that we are not ready to break out yet. Even if we did, there is a lot of noise above that will cause some issues. Many people are not really sure what to do with the US dollar in the short term, so we have a lot of volatility ahead. However, the silver market will go much higher, as we could continue to see central banks around the world flood the markets with currency. I look at pullbacks as an opportunity to pick up “cheap silver”, so it is likely that plenty of people are looking for value.

The $23 level underneath is massive support, as it is not only where we have seen the buyers jump back into the market, but we have also seen the 38.2% Fibonacci retracement level show up there. I do not have any interest in shorting silver. Longer term, this market goes to extraordinarily high levels. It is not only the Federal Reserve, but it also is the Reserve Bank of Australia, European Central Bank, and the Bank of England that are all going to be flooding the markets with liquidity, thereby driving up the demand for hard assets such as silver. Under no circumstances will I be selling silver, because even if we do see the US dollar strengthening, both can go in the same direction eventually, but the short term directionality is of course very negatively correlated.