The silver markets are still fluctuating during the trading session on Wednesday, just as we saw the markets calm down after the massive selloff on Monday. The market is getting closer to building a bottom or a base, from what I can see so far. This is not to say that we cannot go lower; there are multiple areas in which I would be very interested in trying to buy silver based upon value.

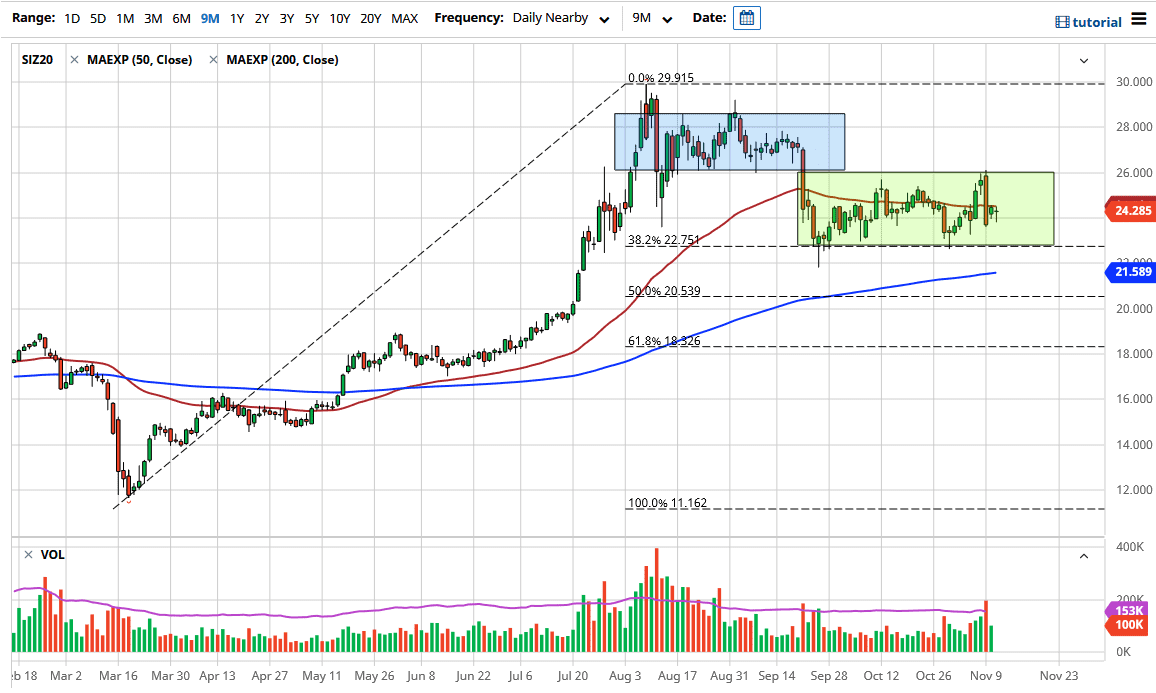

Some of those areas would include the $24 level, the $22.75 level - which is also the 38.2% Fibonacci retracement level - and the 200-day EMA. After that, the absolute “floor the market” is closer to the $20 level. If we were to break through all of that, then I would suddenly become very bearish of silver. But there are so many different fundamental reasons for silver to go higher that I find it very difficult to short it right now.

One of the main reasons silver should continue to go higher over the longer term is that the global central banks will continue to flood the markets with fiat currency, thereby driving down the value of paper money. People start to look for hard assets at that point, and silver is on that shortlist. It will lag gold, but they do tend to move in the same direction given enough time. This is the main reason that lag is out there: the silver market also has a significant industrial demand component built into it.

In the technical analysis, the 50-day EMA above is going to cause a certain amount of resistance. So if we break above that, the market will return towards the top of the green box I have on the chart, which signifies we are going to the $26 level. If we break above there, then the market is likely to go looking towards the $27 level above, followed by the $28 level which was a major resistance barrier. I am not saying that will happen right away, but that is my overall attitude longer term.