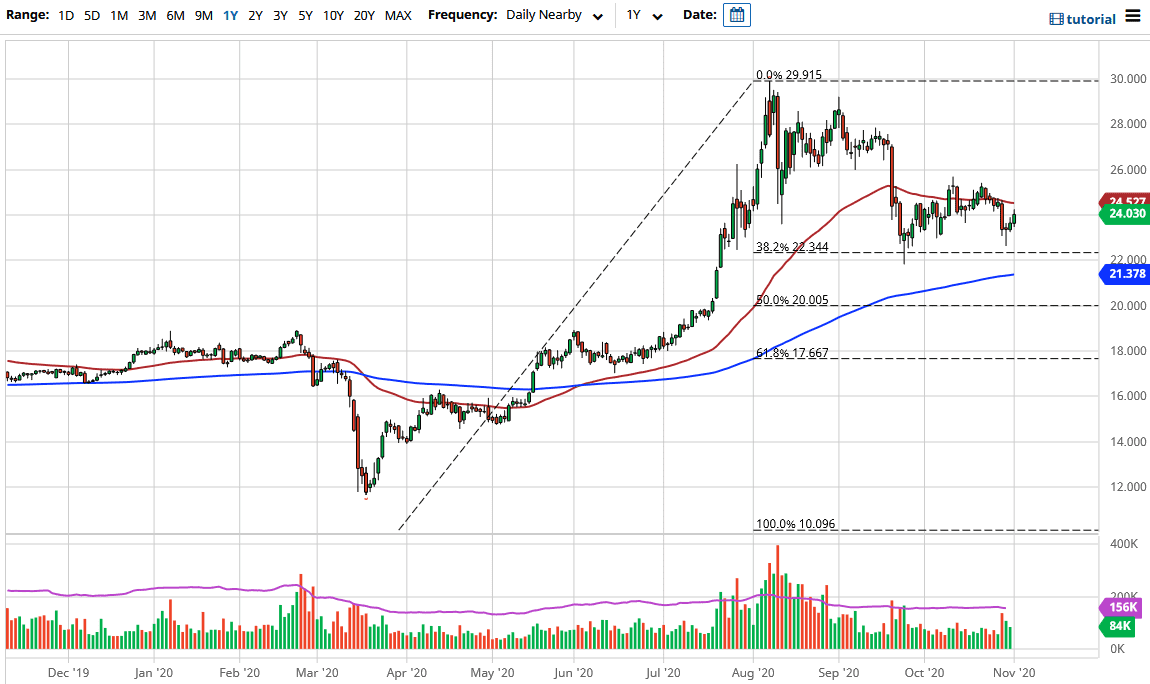

The silver market rallied during the trading session on Monday as traders came back to work, but it looks as if the $24 level will continue to cause trouble. The market looks like we continue to bounce around between the $22 level underneath and the 50-day EMA above, or perhaps even the $25 level. Looking at this chart, we are going back and forth in the short term, and a move out of this range needs a catalyst to get going. There are plenty of reasons to think that we will eventually get a big move.

Looking at the calendar ahead, many traders will be paying attention to the US election on Tuesday. Unfortunately, it is unlikely that we will have a clear-cut decision by the end of the day, and it may even become a multi-day issue. We also have the Bank of England, the FOMC meeting, and the job numbers on Friday. So there are multiple points during the week where we could see the US dollar take off or break apart, which will have its typical influence on the silver market in general.

It is worth noting that the silver market is sitting above the 38.2% Fibonacci retracement level, which is at the $22 level. We have the 200-day EMA underneath there, and all of that could cause some support. If we break down below that, then we will go looking towards the $20 level. This is a particularly interesting area because it was the scene of a major breakout. But it is also a large, round and psychologically significant figure. Further adding to the importance of this level is the 50% Fibonacci retracement level which is there as well (between the $20.50 - $20.00 levels.) So $20 is going to be crucial, and would be an area in which I would become a bit more aggressive about going long. Over the longer term, I do believe that silver continues to grind higher but the next week or so is going to be extraordinarily turbulent, which could cause major issues with silver.