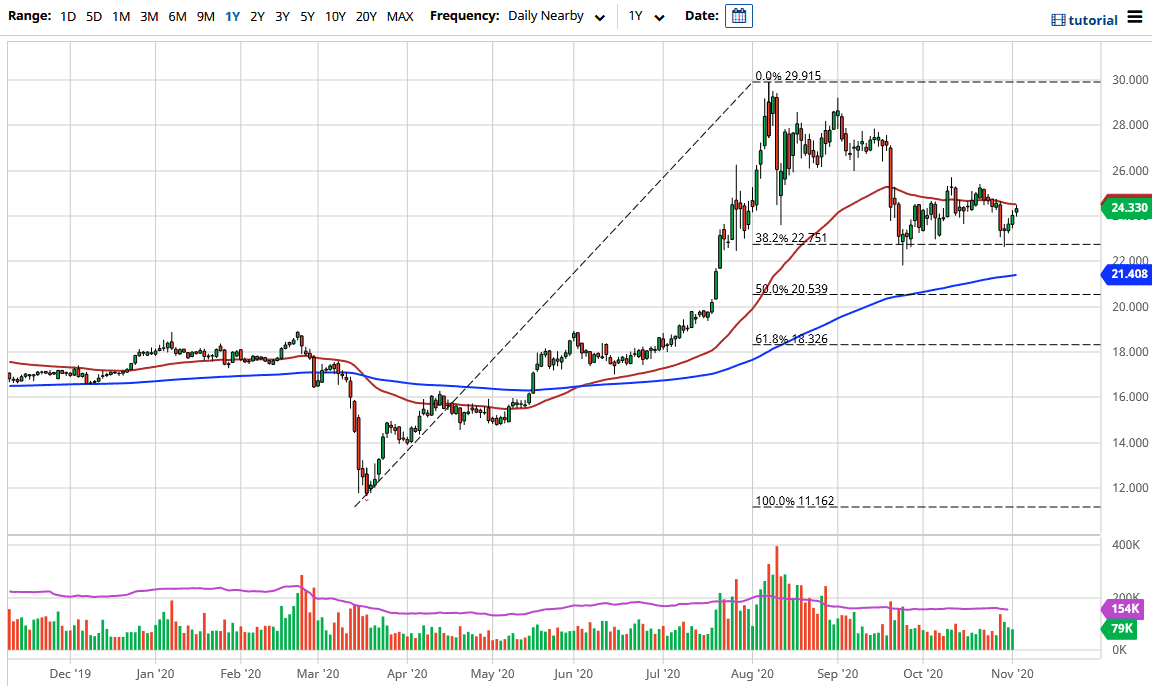

Silver markets have gapped higher to kick off the trading session on Tuesday, reaching towards the 50-day EMA before pulling back again. This is a market that will move with a negative correlation to the United States dollar, as we have been very negatively correlated as of late, with as much as a -.9 ratio. Looking at this chart, we are likely to see volatility in this area, since we are also right around the 50-day EMA. I like the idea of buying dips, because this is a market that should eventually take off but has a lot of noise above it.

The $22 level underneath is significant support, and also has the 200-day EMA racing towards it. The market is likely to continue to see buyers underneath, and eventually it will be a scenario in which people will return to “buy on the dips.” This is mainly because central banks around the world will continue to see the need to flood the markets with liquidity, which should drive up the value of hard assets such as silver going forward.

If we were to break higher from here, we need to clear the $26 level to go looking towards the $27 level, which is where we have seen a lot of selling pressure in the past. Then we go looking towards the $28 level. The market is likely to continue to see volatility, and that is especially true of silver which has more volatility than other markets. A lot of back-and-forth trading is probably what we are going to see. But overall we are looking at a scenario in which there are plenty of reasons to go long from the longer-term standpoint, so eventually the fundamentals will win out. I think a simple matter of patience is what is needed. The longer-term attitude certainly should pay off if you are comfortable with taking it more along the lines of investing in less than along the lines of short-term trading.