The one great thing about trading indices is that in the United States, there always seems to be a reason to buy them. This is perhaps because they are so skewed towards a handful of companies that almost everybody tries to buy. Or, perhaps it's the fact that the central bank is so complicit in trying to lift the markets over the longer term. This is not to say that we cannot have serious pullbacks occasionally, but somebody always steps in to pick them up. In that sense, they are highly manipulated because you are not buying a “basket of 500 stocks.”

It is through that prism that you need to trade the S&P 500: understanding that a handful of so-called “Wall Street darlings” make up the biggest weight of the index. In other words, as long as some of the most popular stocks do well, the index will follow. There have been days where only about 20 stocks have been positive, and the index rose right along with it. Because of this, selling the S&P 500 has been extraordinarily dangerous, especially since we had changed regimes after the Great Financial Crisis about 13 years ago and central banks continue to throw liquidity at the market. With the massive amount of liquidity, people are forced into riskier assets and, by extension, stocks. The Federal Reserve's release of its latest minutes did suggest that it was willing to step up purchases if necessary and continue to flood the markets with even more liquidity, which is something that Wall Street will be happy about, due to the fact that Congress seems to be dragging its heels with fiscal policy.

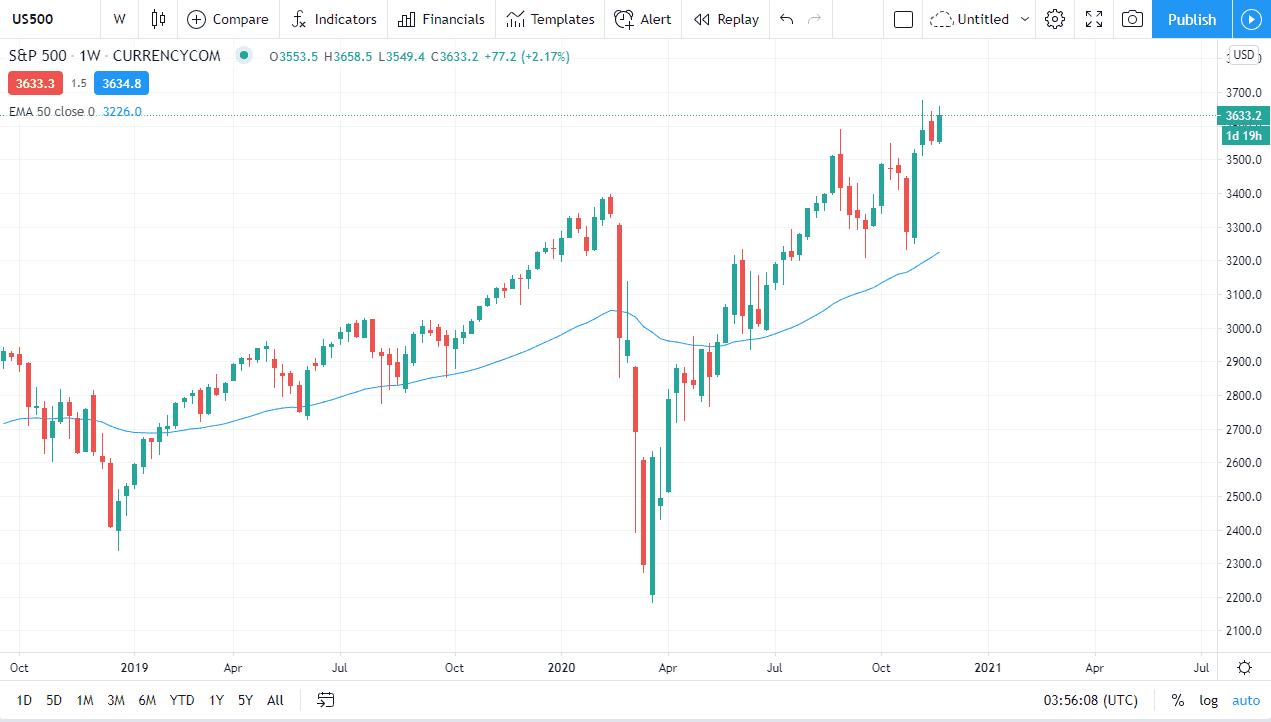

The S&P 500 is almost sure to continue rallying into the end of the year due to the announcement of at least three vaccines coming next year, and Wall Street is starting price and earnings for the year 2022 which, although absurd, is the story that they are going with now. The idea is that we are going to see the global economy get back to normal sometime in 2021, and people are trying to “front run the move.” But we do have a lot of economy slowing down and even locking down between now and then, so a short-term pullback is most certainly possible. With all of the money out there and money market funds, it is likely that people will look at pullbacks as potential value. Buying on the dips has been working for some time, and December should be more of the same. Currently, the support level to pay the most attention to will likely be 3530. Longer term, I believe that we are looking at a move towards 4000.