The S&P 500 has done very little in thin electronic trading on Thursday as Americans were away for the Thanksgiving Day holidays. Ultimately, this is not a huge surprise as every year the limited electronic trading produces very little in the way of momentum. That being said, we are at extreme highs so it is not a huge surprise that the market would lose eight points. However, it should be noted that there are plenty of supportive areas underneath that will more than likely come into play, so I look at any pullback between now and the weekend as a potential buying opportunity.

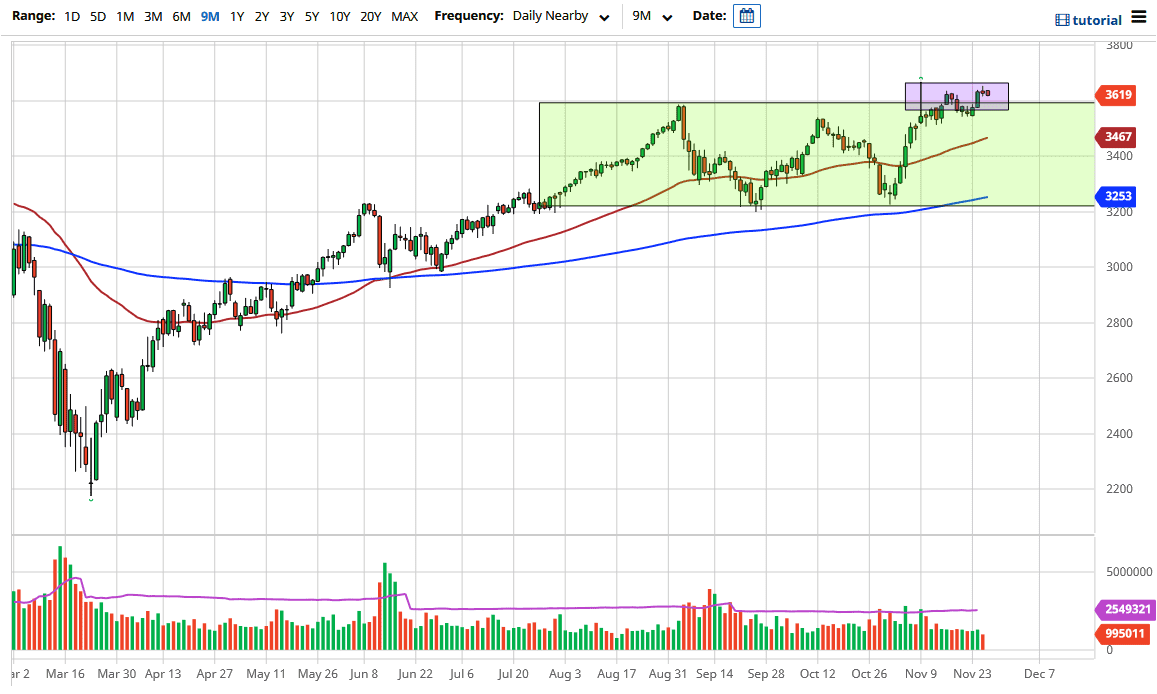

As liquidity continues to flood into the market it makes sense that the traders out there will continue to pick up risky assets such as the S&P 500, as the idea of wealth preservation becomes a serious concern. Ultimately, I do think that dips get bought into and the next couple of days could provide that potential opportunity. The 50 day EMA is starting to reach higher, currently sitting at the 3467 level, and likely to continue to accelerate. After all, we have seen a nice run higher and now it looks like we are simply trying to digest some of those gains.

The Federal Reserve and its most recent Meeting Minutes suggested that they were willing to support the markets as long as necessary, which is nice to hear that they are finally admitting that the markets are their biggest priority. This of course has been known by most participants, as liquidity measures are injected every time Wall Street throws a tantrum. It is through that spectrum that you need to look at this market and realize that pullbacks are buying opportunities shorting the S&P 500 is a great way to lose money, with the exception being the occasional volatile selloff. Having said that, it looks like we are trying to break out of the recent consolidation area which measures for a move to the 4000 level. Longer-term, I think we definitely get there due to the fact that it would simply be an extension of what we have been seeing play out in the market for the last 13 years or so. Liquidity comes in, asset prices go up. We are simply killing time and digesting recent gains before the next move to the upside.