The stock markets rallied during the trading session on Thursday again, reaching towards the 3500 level. Having said that, the market did break above there slightly but as we settle for the day, we are basically hanging around the same region. This is a market that I think continues to see a lot of noise, mainly because we have so many different things moving at the same time. Not the least of which of course is going to be the jobs number coming out on Friday, and that always causes noise. However, this is a special situation in the sense that we are still waiting on some type of US election results, although it is starting to look likely that it will be a Joe Biden presidency with a Republican Senate. In other words, there is a good chance that there is gridlock for a while, which is always good for markets.

On the other hand, the question now turns to stimulus. Senate Majority Leader Mitch McConnell has already suggested that stimulus would be the first thing on the docket when they get back, but at this point in time stimulus looks to be smaller than originally thought, and if that is the case it is hard to tell how the markets will take that. Furthermore, we have to keep in mind that if the election is not decided going into the weekend, we may see further selling, unless of course the outcome becomes even more obvious, which is also a possibility.

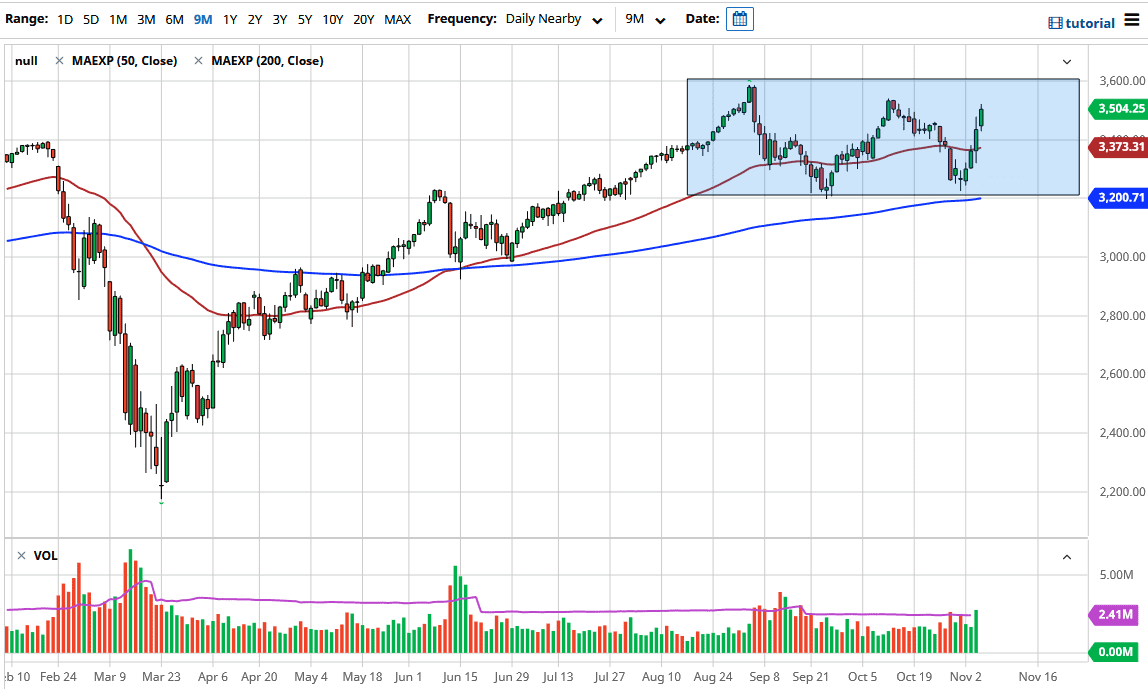

Even if we pull back from here though, I think that the market is likely to see plenty of support underneath that we can take advantage of. After all, the 3400 level underneath could be important, and it is backed up by the 50 day EMA. After that, we have the 3200 level which is also backed up by the 200 day EMA. With that being the case, I like the idea of buying dips that show signs of support, especially if we get a support of candle on the daily timeframe. That being said, if we break down below the 200 day EMA, which is something that I do not expect to see in the short term, then we need to step on the sidelines and reevaluate the entire situation. If we break above the 3600 level, the measured move suggests that we are then going to go looking towards the 4000 handle.