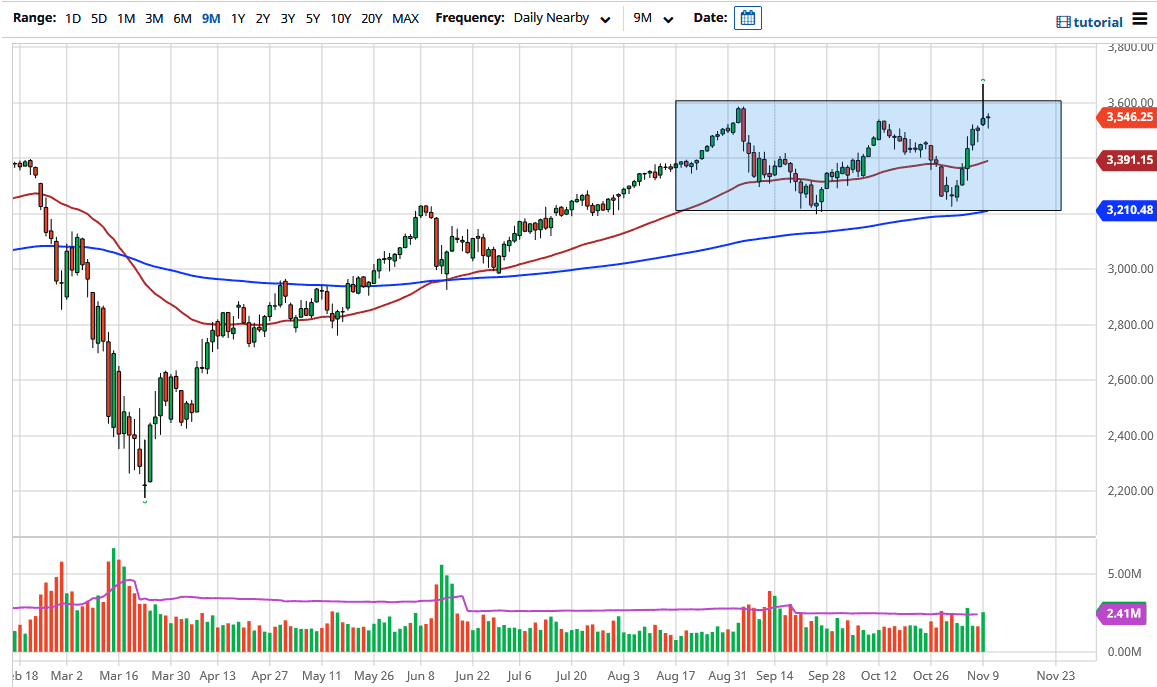

The S&P 500 has fluctuated during the course of the trading session on Tuesday, showing signs of stability again. This is a particularly interesting candlestick, because we had formed a massive shooting star on Monday which showed a lack of momentum to go higher. The market is paying close attention to the 3600 level, which is a large, round, psychologically significant figure and the recent high that we had seen. Because of this the market continues to find buyers on dips.

To the downside, the 50-day EMA should offer plenty of support near the 3390 handle, so the 3400 level should continue to see interest. People are beginning to look at stimulus as being a reality, and we will see traders try to adjust their outlook for the stock markets. But the question now is whether or not stimulus is going to be big enough. On Monday, people were concerned about the fact that the Republicans could very well hold on to the Senate, and with a better-than-anticipated jobs number, it was possible that stimulus could be smaller. During the session on Tuesday, people started focusing on the fact that Joe Biden is going to be president, and therefore stimulus will be bigger.

In other words, we have the usual nonsense when it comes to the narrative vacillating in this market.

Buying dips will continue to be the way going forward. If you can imagine the overall consolidation area getting broken to the upside, we should have a 400-point run, which is a target of 4000. Wall Street and technical traders love large, round, psychologically significant figures. I like the idea of looking for value, hoping that we will get it soon. Looking at this chart, there is no argument for shorting, and owith the way that these indices are built, it makes no sense to short this market. You are either buying value or playing momentum to the upside.