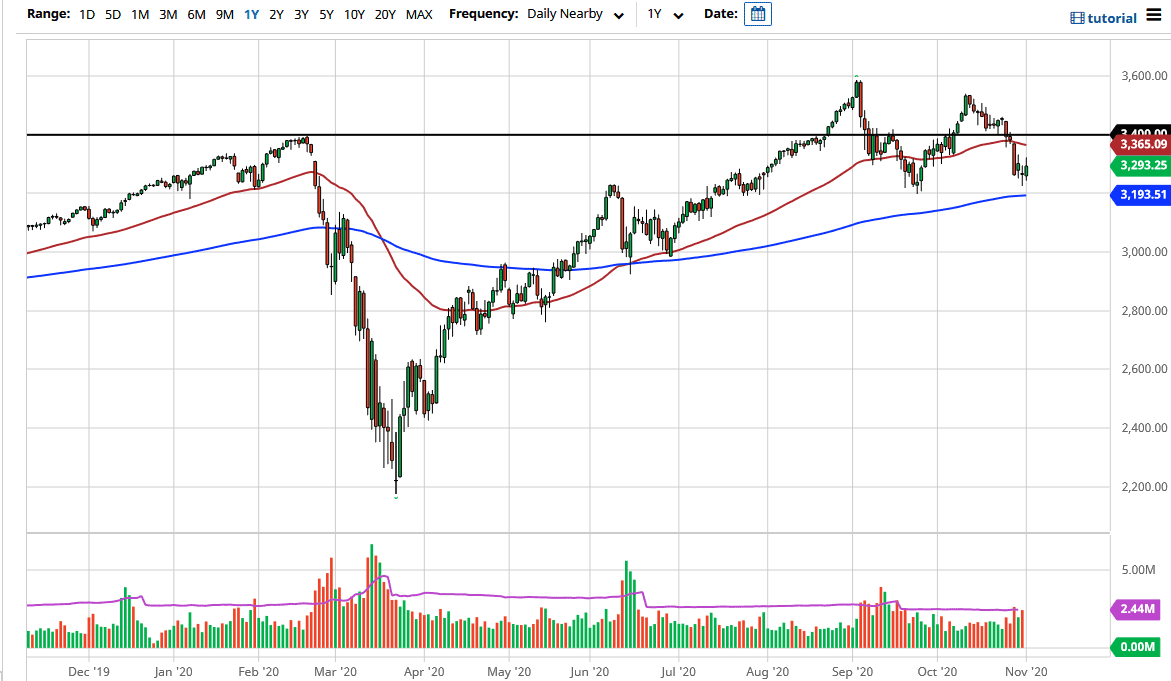

The S&P 500 has fluctuated during the trading session on Monday, showing signs of stability after selling off rather drastically. I had mentioned on Friday that perhaps we would see resiliency just above the 3200 level, and we even reached as high as the 3300 level during the trading session. I think a lot of traders are out there treading water heading into the election because they have no idea what to expect after the election.

There are many reasons why this market could go either higher or lower, not the least of which would be the makeup of the US government. We have the FOMC later this week and of course the jobs number. We also have a couple of ISM numbers coming out of the United States as well, so it is only a matter of time before volatility gets retail traders into trouble this week. My email and Twitter feed is full of people asking me what to do, and the advice that I give most people during times like these is to simply sit on the sidelines. It is not as if there will be a market next week.

I know that people are going to be upset with the idea of not clicking buttons rapidly all week, so the most obvious set up would be a continuation of the consolidation that we have seen between the 3200 level and the 3500 level. I know that is a large range, but it is the market we have right now. The VIX is still well above 35, or at least it was the last time I checked. The 200-day EMA is sitting just below the 3200 level, so that could give us an opportunity to bounce off that. But there are far too many questions out there to think that this market is going to continue to see a lot of jitters. so it is likely that we would see a lot of difficult short-term trading. The candlestick for the day looks less than exciting, so I think the Tuesday session will be very choppy and sideways.