The S&P 500 fluctuated during the trading session on Friday as traders went home for the weekend rather early based on price action. The market should also keep an eye on liquidity measures, because that is all Wall Street seems to care about. As long as the money is cheap or free, people will throw money into the stock market. Do not get too hung up on the idea that the economy is going to struggle due to lockdowns, because the stock market has been completely divorced from the economy for some time.

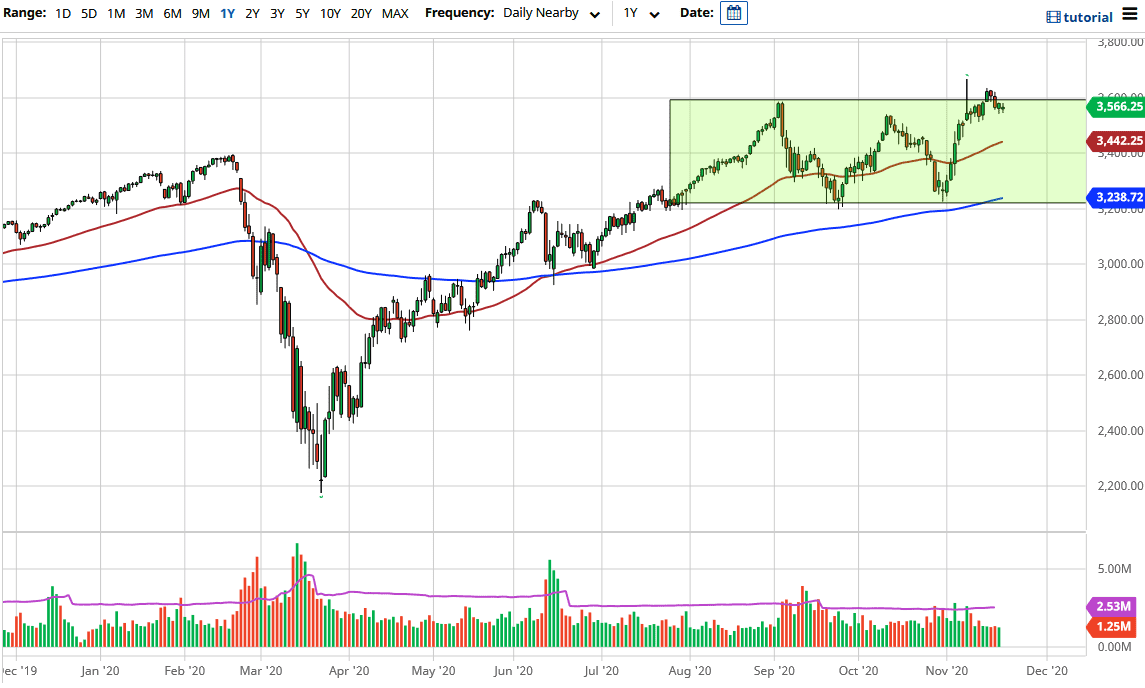

Looking at this chart, you can see that we have rallied rather significantly as of late, but the last week or so has been a bit short in the way of momentum. That's understandable, because we need to see some digesting from the parabolic acceleration two weeks ago. This is a market that continues to hear a lot of noise in general, but eventually we will see a certain amount of buying.

Even if we do pull back from here, there are plenty of support levels underneath that come into play, not the least of which will be the 3500 level. After that, we would be looking at the 50-day EMA and then possibly even the 3200 level underneath. The market is likely to continue to find reasons to go higher, as it typically will do. Every time we pull back you should be thinking about picking up value. After all, the stock market always finds a reason to go higher based on the latest narrative. Not until we break down below the 3200 level would I be concerned, and that is not likely to happen anytime soon. If we break down below there, you will start to hear Wall Street clamoring for a bailout, which they always get. There is no point whatsoever in shorting this market, and eventually we will break out to the upside and continue going towards the 3800 level, possibly the 4000 level after that.