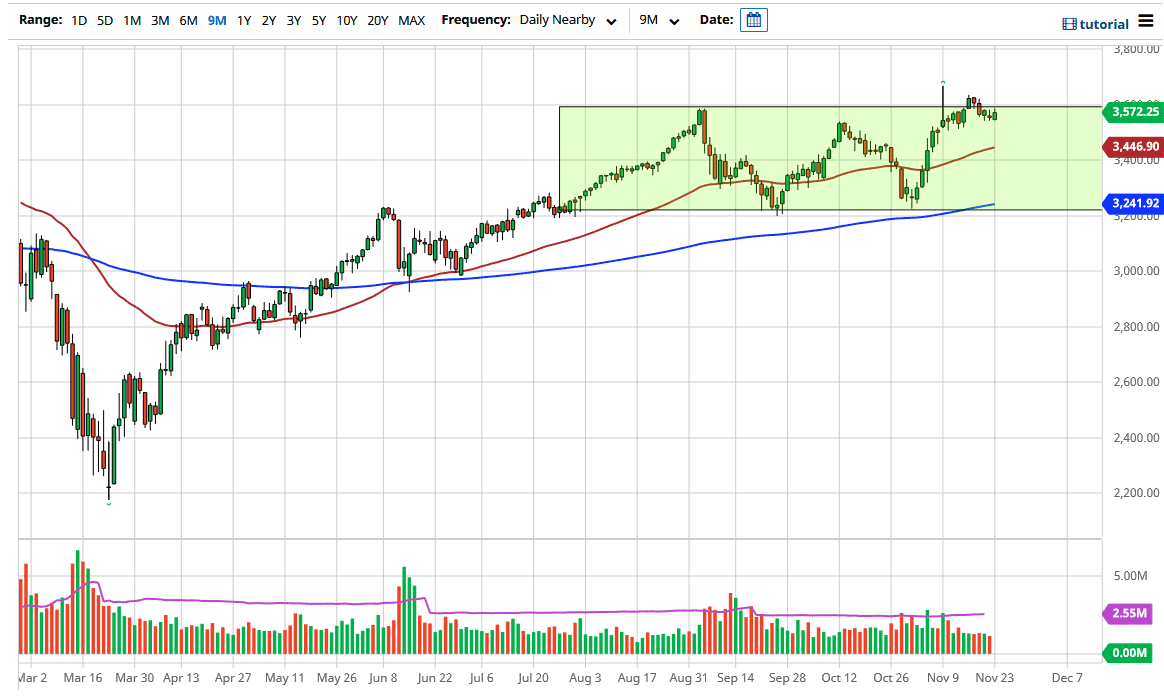

The S&P 500 rallied just a bit during the trading session on Monday, reaching towards the 3600 level. The market is struggling with the level, which has been a major issue. There has been a lot of pushback in this general vicinity, so it is no surprise to see that we struggle to get above there. It is likely that the market will continue to see a lot of resistance above, but we will eventually break out to the upside and go looking to test the top of the shooting star due to the vaccine announcement.

Looking at this chart, there is plenty of support underneath which should continue to attract buyers every time it dips. The 50-day EMA sits at the 3447 level and is sloping higher. The market should be thought of as a potential “buy on the dips” market. After all, the liquidity measures that the Federal Reserve and the US government will take to enable the stock market will continue, so we will see plenty of people jump into this market based on that, if for no other reason.

Underneath, there are multiple areas that offer support, so I will be looking at this chart from the daily close standpoint. If we get a supportive candlestick underneath, there will be plenty people who jump in and I will be looking for an opportunity to follow them as well. I will take this on a day-by-day basis, so I will let you know in 24 hours what I see. But with Thanksgiving this week I am not looking for much. We will simply fluctuate and try to figure out a way to move forward. I have no interest in shorting because you cannot short indices right now. They are built to go higher, which is shown by the fact that they are not weighted equally. They tend to have just a handful of stocks moving them overall, and the S&P 500 is no different.