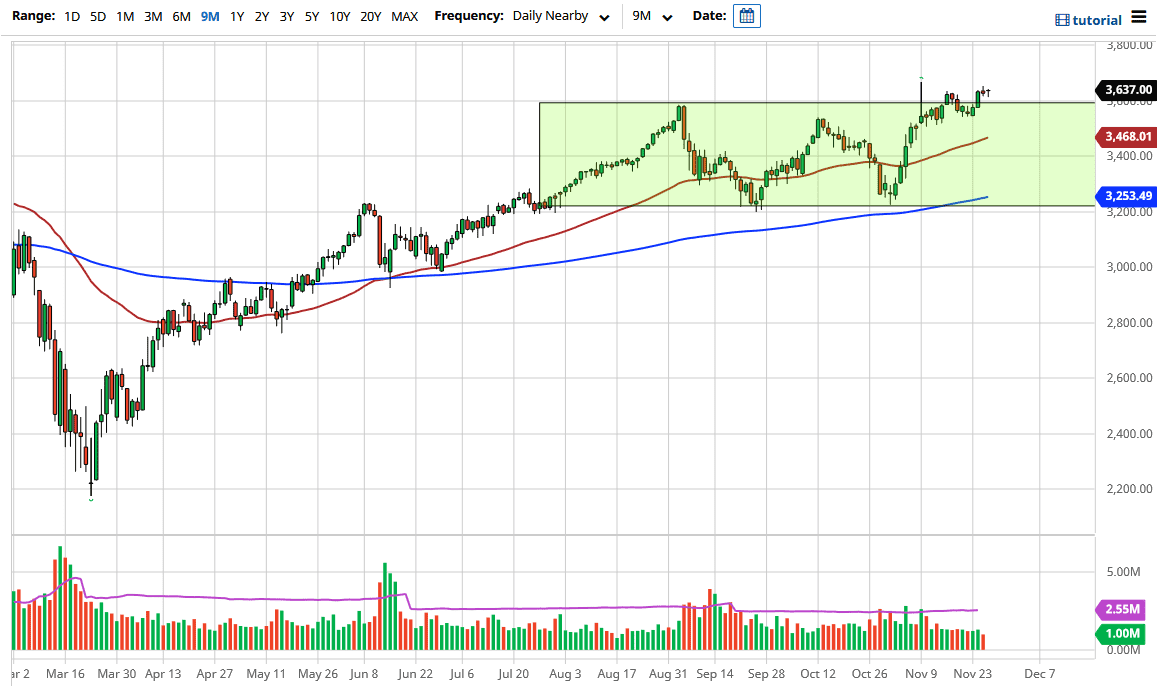

The S&P 500 pulled back a bit during the trading session on Friday to then turn around and show signs of strength. By forming the hammer that it did, it showed that there are still buyers out there trying to defend the 3600 level. That is a large, round, psychologically significant figure from which we have broken out, so it follows that we would see some “market memory” in that area. Breaking down below that level does not necessarily mean that it is a big issue; just that we may go down to the 3500 level.

On the other hand, if we continue to go higher, then it is likely that we will make an all-time high and continue going to the upside. When you take the consolidation area from which we broke out, it does measure for a move to the 4000 handle - but it does not mean that we will get there right away. The 50-day EMA is sitting at the 3468 handle, and I think that will be a short-term “floor in the market”, unless something fundamentally changes. Right now, it looks as if the US dollar is starting to take it on the chin, which will help the stock market as well.

If we do take off to the upside, it will continue to be a “buy on the dips” scenario, essentially continuing the same behavior that we have seen of late. Keep in mind that we had a surge higher in the early part of November and have since been churning away and digesting the gains. We have seen more of a tilt to the upside, which gives us information as to where the next move will go. Furthermore, the longer-term chart is in an uptrend, so there is no point in trying to fade any bullish moves, and simply look for value as it occurs in this market. Remember that this was Thanksgiving week, so it was relatively thin. I believe that we are going to go higher between now and the end of the year.