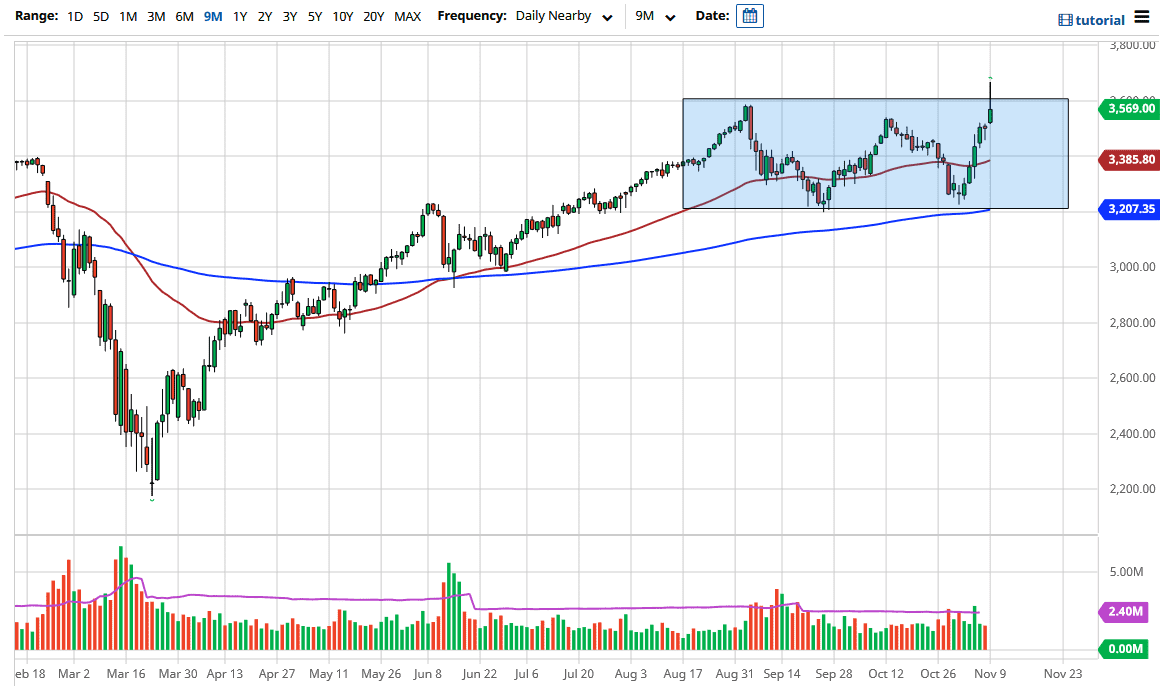

The S&P 500 E-mini contract initially gapped higher to kick off the trading session on Monday, and then went into hyperdrive after Pfizer announced its coronavirus vaccine with over 90% efficacy. The market broke clearly above the 3600 level, and those who bought there are now in a world of hurt. By the end of the day, we did end up forming a massive shooting star at the top of the consolidation range that I have marked on the chart.

This type of ugly trading action is not conducive to building confidence, so if we were to break down below the candlestick it is likely that we could continue to pull back towards the 50-day EMA. The way this day closed was not conducive of a strong run higher. I am not calling for a bear market suddenly; only that we are flirting with danger. There are a host of issues that could bring the S&P 500 right back down.

One of the first things that comes to mind is the Senate race in Georgia. If we do in fact see the Senate flipped completely to the Democrats, it would cause major problems in the stock market. Furthermore, while the mainstream media are not reporting it, there are dozens of lawsuits being filed between now and confirmation of the election, which could throw a surprise out there. After that, you will have to worry about the US dollar surging higher like during the trading session, so there are many things that should keep this market somewhat in this range.

If we break above the top of the candlestick, which is over 100 points higher than when it closed, then we would be going much higher. The fact that we could not keep the gains for the day overall does suggest that the coronavirus news was a “sell on the news” event. You probably need to be looking for value that you can take advantage of on these dips. I anticipate that this week is going to be worse than the last one, as far as volatility is concerned.