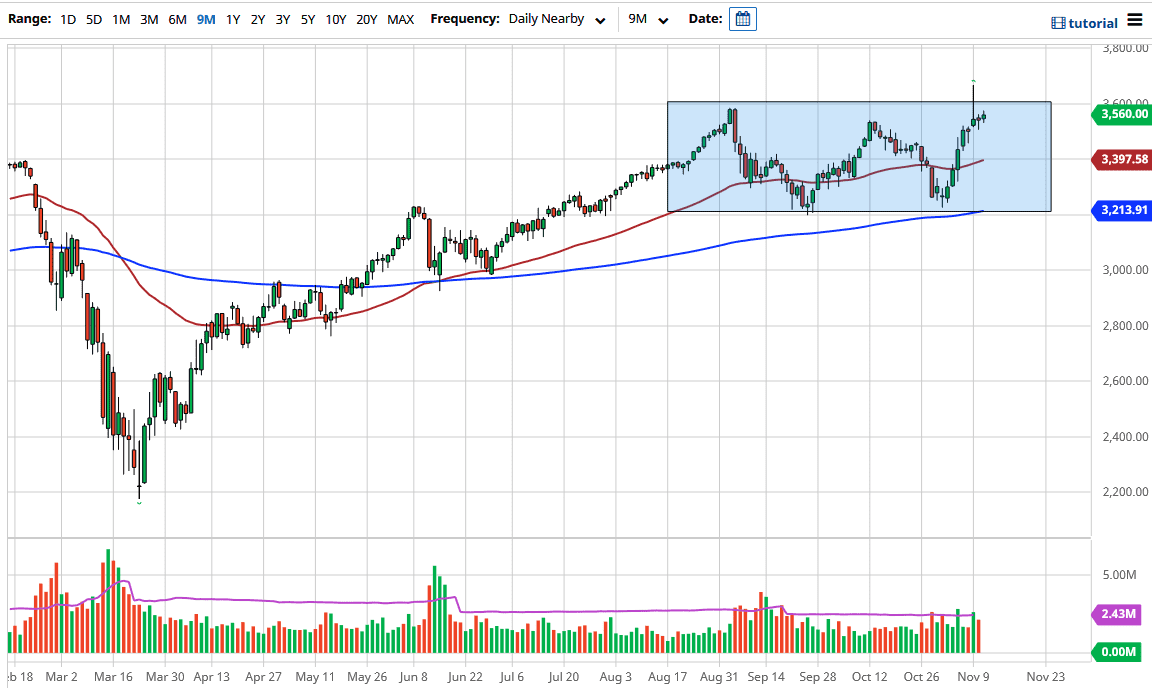

The S&P 500 rallied during the trading session on Wednesday, but we are still below the 3600 level, an area that has been a significant structural and psychological barrier. Now that we are sitting at the top of the overall range that we have been in, I would not be surprised to see this market pull back. Looking at this chart, you can clearly see that the 3600 level has been an area in which sellers have come in and started selling for the last couple of months.

The shooting star from the Monday session is very negative looking and will continue to represent a lot of selling pressure. There are many things going on that could cause issues as well, so we should be paying close attention. The stimulus package out of the United States is going to be smaller than people originally thought, so stock markets may react somewhat negatively to that. But there should certainly be stimulus coming nonetheless.

Another thing that is worth paying attention to is the fact that the coronavirus numbers are starting to pick up again, which has a lot of people concerned about the possibility of shutting down certain economies. New York City is already tightening up some regulations again, so one has to wonder how long it will take for the rest of the nation to follow. It is obviously a local issue, but if we get a “rolling plague” type of scenario, then it is difficult to work through.

I am not looking for a selling opportunity; rather to pick up this market “on the cheap” when I can. The 3400 level is an area of interest as it has the 50-day EMA sitting right there, and then the 3200 level underneath. This is a market that I think does eventually break out because Wall Street always find a narrative to clutch onto. If we do break out above the candlestick from the Monday candlestick, then it is possible that we could move as high as 4000.