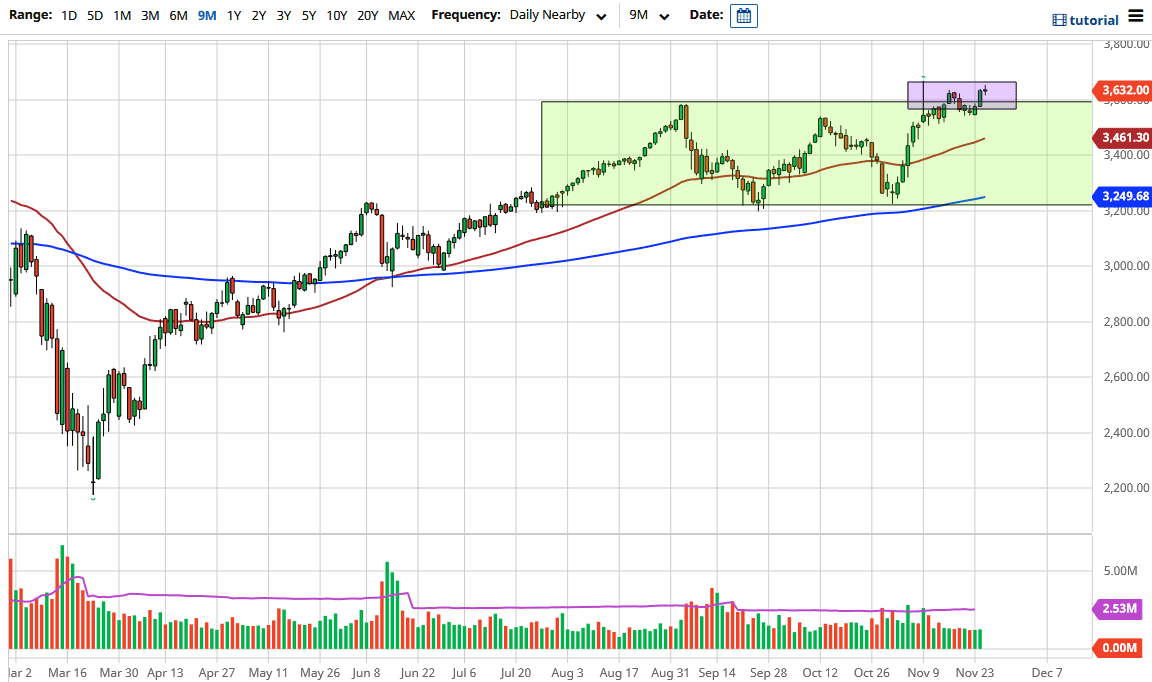

The S&P 500 rallied a bit during the trading session on Wednesday but gave back the gains to turn around and form a shooting star. It looks like we may get a short-term pullback, but we will find plenty of buyers underneath as we continue to see the market rally from the liquidity measures being thrown into the marketplace. It is therefore likely that the stock market traders in the United States will continue to pick up stocks every time they dip. However, the Thanksgiving holiday will have a major influence on the market as the underlying index will not be open. However, the Globex markets will be open for shortened trading, so if you get a significant pullback due to a lack of liquidity, you may have the ability to take advantage of the usual appetite for risk assets that we have seen most of the time over the last 13 years.

Markets no longer move on anything other than monetary flow as far as liquidity is concerned, and as long as the Federal Reserve is willing to pump the system full of digital dollars, the US stock markets will continue to go higher. But you need to find value and you need to find pullbacks in order to take advantage of them. The 3600 level would be an area of support, but then again, so would the 3500 level and the 3450 level, which is basically where the 50-day EMA is.

If we were to break above the top of the shooting star, it would not only break the highs of the day but it would also break above the top of that massive shooting star that we had a couple of weeks ago. That would be a major accomplishment by the bullish traders out there - offering the next leg higher for longer-term traders to hang onto. I have no interest in shorting this market, because sometimes you have to simply “embrace the stupidity”, and all of the useless mantras about how “the markets are a forward-looking mechanism.” It is not that there is no truth to that; it is just that Wall Street is now talking about the economy in 2022, suggesting that anything in 2021 is simply a bonus.