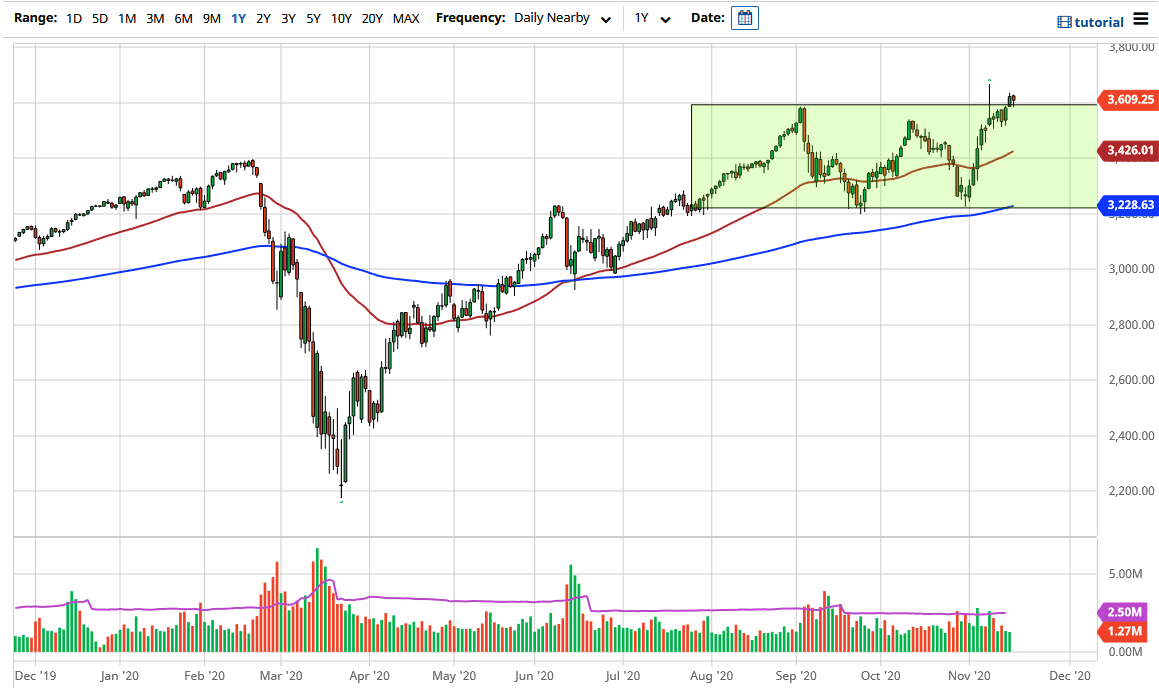

The S&P 500 pulled back during the trading session on Tuesday as we reached towards the all-time highs yet again. Remember, last Monday we had a massive spike in the stock markets after the announcement of a coronavirus vaccine came out. However, we gave back all of those gains rather quickly, which is something to be concerned about.

This market is probably going to go higher, but clearly does not have the momentum right now. Therefore, I would anticipate that the dips will continue to be bought, and we even saw some of that later in the day. I think that the market has significant support near the 3500 level, which is a large, round, psychologically significant figure, and an area in which we have seen buyers in the past.

Looking at this chart, you can see that we have certainly gotten ahead of ourselves, so I think a pullback is healthy. We do not want to see this market go straight up in the air, as there has been so much in the way of “FOMO.” I do not like chasing these types of moves, so I like the idea of pulling back and looking for value. I have no interest in shorting this market, as there are so many people out there who are willing to jump in. After all, Wall Street builds itself upon liquidity and does not care about fundamentals, at least not for the short term. The market continues to base its move higher on the fact that the “that the Fed has your back”, so that is what most people trade on. That does not mean that you should jump in right away and start piling into the S&P 500, but clearly you cannot short this market.

The 3500 level, the 50-day EMA and the 3400 level all offer decent buying opportunities, as does the 200-day EMA which is closer to the 3200 level. If we were to break down below there, it could change things. But right now this is not anywhere close to where we are, so I am not concerned about it. Longer term, I expect the S&P 500 to go looking towards the 3800 level.