The S&P 500 had a brutal close during the trading session on Wednesday as everything fell through the floor. The market still has plenty of buyers underneath and eventually the traders will get involved based on some narrative. Wall Street loves narratives, and money will chase momentum anytime it gets an opportunity to do so. You will note that the last couple of days I have suggested that perhaps we were getting a little overdone, and Wednesday started to show that.

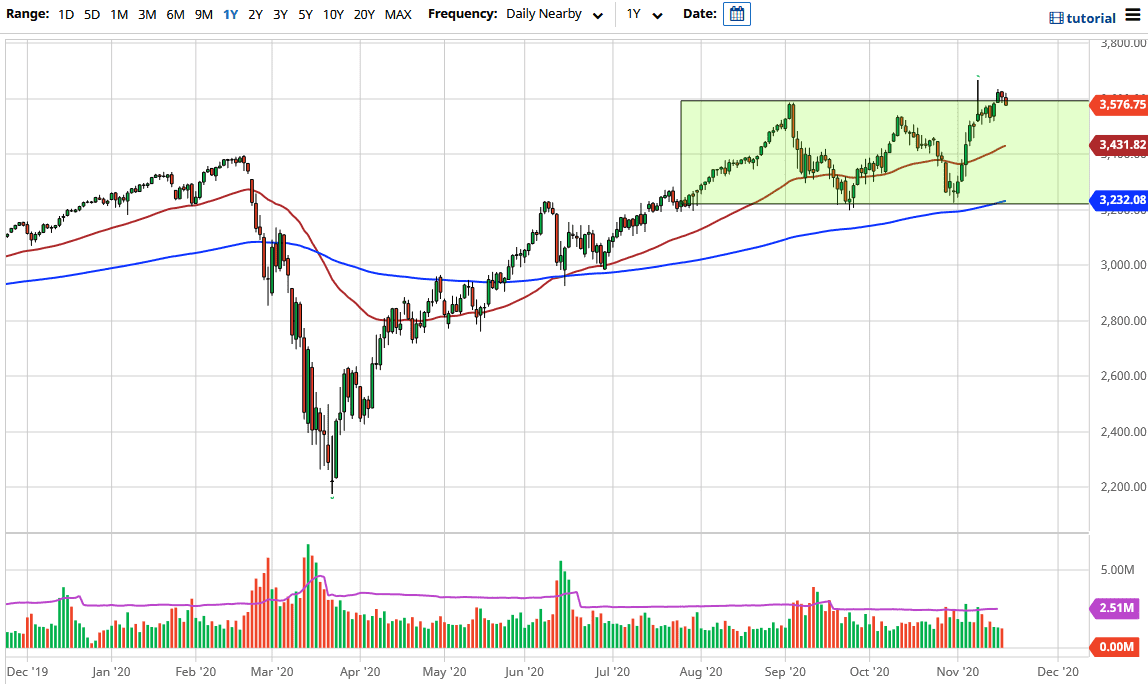

The fact that the market closed at the bottom of the candlestick tells me we may have a little bit further to the downside ahead of us, but right now there are plenty of areas in which I would expect to see buyers. For example, the 3500 level should be massive support, as it is a large, round, psychologically significant figure, and an area in which we have seen buyers in the recent past. However, if we were to break down below that level, then the 50-day EMA after that would be targeted, which is at the 3431 handle. The 50-day EMA did hold off the NASDAQ 100 on a recent pullback, and I suspect that it would do the same thing over here.

A breakdown below that level could send the market looking towards the 200-day EMA, which is the bottom of the green consolidation area that I have marked on the chart, but I doubt that we will go that far. We need an event to make that happen, so you would likely see a news story accompanying that move. At this point, I believe it is more likely that we will break out to the upside and, if we clear the bullish candlestick from last Monday, then the market will go looking towards the 3800 level, possibly even the 4000 level after that. We are in an uptrend, which we should keep in mind because the trend will be your friend going forward. Wall Street will get its cheap and free money given enough time, and Wall Street knows that as they essentially own the Federal Reserve right now.