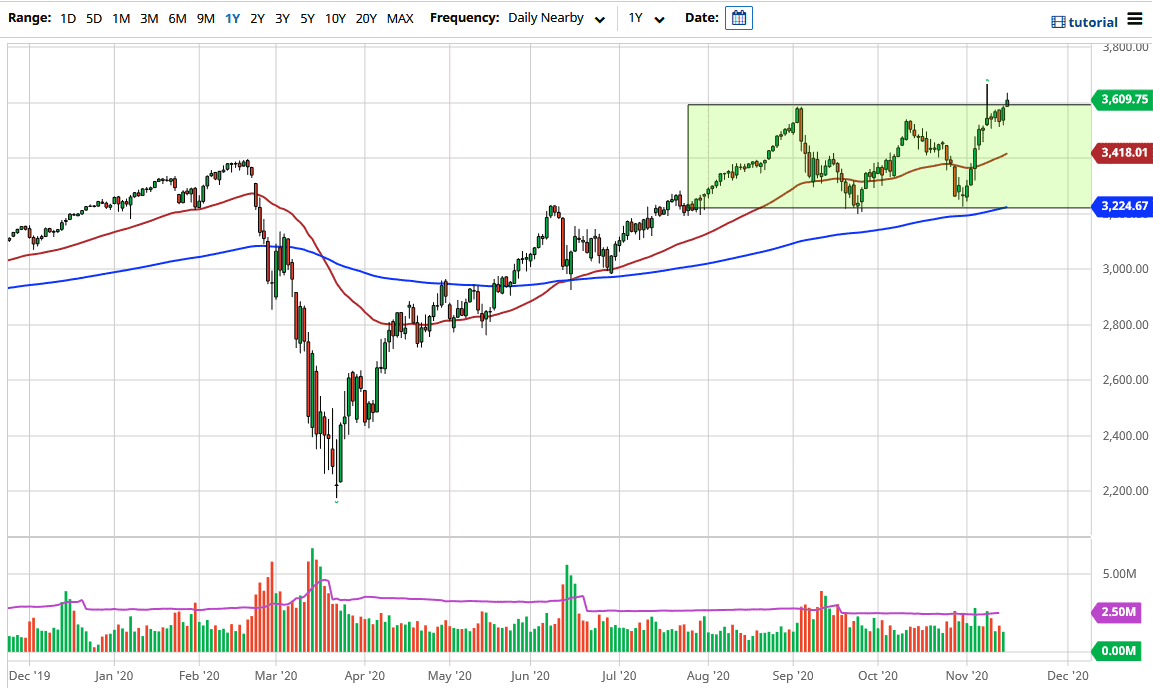

The S&P 500 initially tried to rally during the trading session on Monday, but gave back the gains as we continue to see exhaustion above the 3600 level. The market is likely to see some pullback, but there are plenty of buyers underneath. The 3500 level should be significant support, but if we break down below there it is likely that we will go looking towards the 50-day EMA. The 50-day EMA is a technical indicator to which many people pay attention, so we need to pay attention to it as well. If we get a supportive candlestick down, I would be more than willing to jump in and buy this market.

If we break out to the upside, then we have to deal with the top of the shooting star that formed on Monday of last week. If we break above there, then we could go higher, but it would be a significant fight to get above there. I think you continue to look at short-term pullbacks as potential buying opportunities. Nonetheless, even if we knew for a fact that we are going to fall during the trading session on Tuesday, I would not be a seller; I would simply wait for a buying opportunity. The market is likely to hear a lot of noise because there is news about another coronavirus vaccine, but it will not continue to go higher.

Looking at this chart, I believe the market is going to continue to find buyers every time we pull back because there is plenty of support underneath, and there is always a possibility that some new narrative will hit Wall Street that will have people going bullish again. Because of this, I think it is just a matter of being patient enough to find value and then taking advantage of it. That has been the play all along, so there is no point in fighting the overall trend. In fact, I do not have a scenario in which I would be a seller.