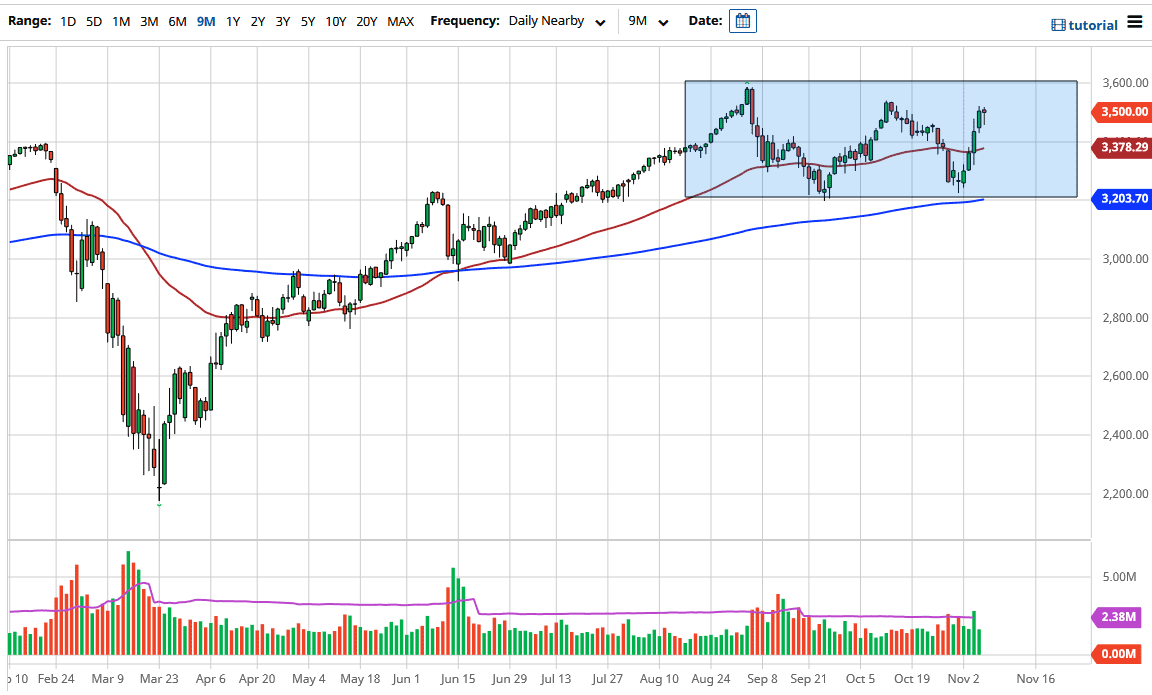

The S&P 500 initially pulled back during the trading session on Friday, but then turned around to show signs of upward pressure. It looks as if the 3500 level is going to continue to see a lot of interest because it is a large, round, psychologically significant figure, and it is an area where we had seen resistance previously.

Looking at this chart, the market looks as if it is trying to form a bottoming pattern before we go higher. But we had gotten overextended, perhaps due to the idea of stimulus that may be smaller than originally thought. Wall Street will celebrate as much. However, given enough time, it is likely that we are going to find buyers. The markets will possibly offer plenty of value underneath, perhaps down towards the 50-day EMA. If we break down below there, then the 3200 level offers support because there has been a “double bottom” down there, as well as because of the 200-day EMA which is a large technical indicator.

If we can break above the 3600 level, however, then the market is ready to go much higher. The 400-point range that we just broke out of should be the measured move that sends the S&P 500 towards the 4000 handle. I do not have a scenario in which I am willing to short this market, due to the fact that we have so much heavily weighted momentum towards just a handful of stocks. Remember, Wall Street tends to have a lot of groupthink, and if there is a narrative that comes out suggesting that we should be buying stocks (and there always is), eventually we take off to the upside. If we do break down below the 200-day EMA, then the market will probably continue to go much lower. But at that point I would be a buyer of the US dollar more than anything involving shorting this market. I would be very interested in buying debt, which we may get one or two of because we have gotten overextended.