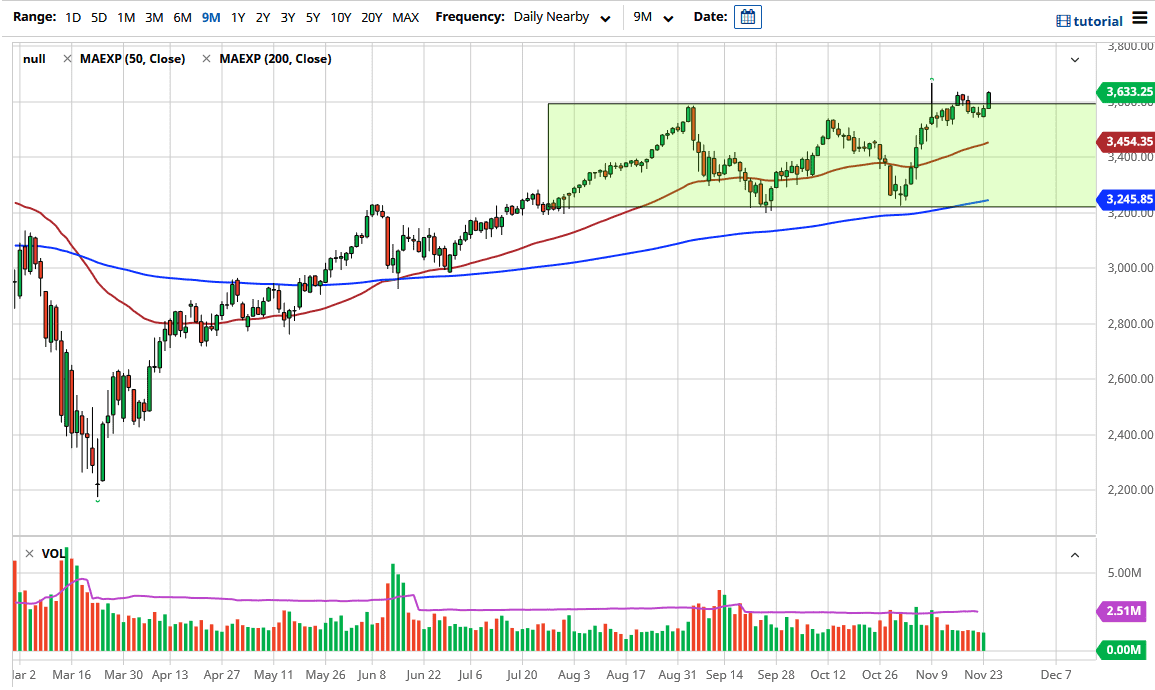

The S&P 500 rallied significantly during the trading session on Tuesday, breaking above the 3630 handle. The market looks as if it will continue to try to build up pressure to the upside. But one thing you should keep in mind is that there is going to be a lack of liquidity, so people are simply buying dips because they do not know what else to do.

The size of the candlestick is larger than the previous one, and the fact that we are closing towards the top of it tells us that we will eventually break out. I think that short-term pullbacks continue to be buying opportunities as we have been in an uptrend, and now it looks like the liquidity is finally starting to take over. With three vaccines coming out relatively soon, it does suggest that we should see a certain amount of money flowing into the market simply because there is nothing else to do.

The Federal Reserve floods the markets with liquidity and forces people into riskier assets such as the S&P 500. It should be noted that the market may continue to try to take out the highs from a couple of weeks ago, when we formed that nasty-looking shooting star. If we can break above the top of it, it is likely that the market will go looking towards the 3800 level. Based on the rectangle that we have just started to break out of, the measured move should send the S&P 500 looking towards the 4000 handle. This does not mean that we will get there overnight, rather that we will get there eventually.

To the downside, the 50-day EMA is going to offer a “floor” in the market near the 3454 handle. If we were to break down below there, that would be a shift of overall attitude, so we would have to see whether or not we could make it down to the 200-day EMA. It seems to be very unlikely at this point, so we will continue to look to the upside. Keep in mind that the Thanksgiving holiday is on Thursday, so Wednesday will more than likely be relatively thin.