The S&P 500 has rallied during the trading session on Tuesday, as we await the results of the US election. It appears that traders around the world started to get bullish based on the prospect of a clear election result, which sets up an interesting problem. It would not take much to spook the markets later in the session during the Globex trading hours; we could wake up in the morning in the United States to a market that is much lower if there is no clear-cut winner. This also comes down to regional Senate races, so a lot of retail traders are about to get an education in US politics if they are not careful.

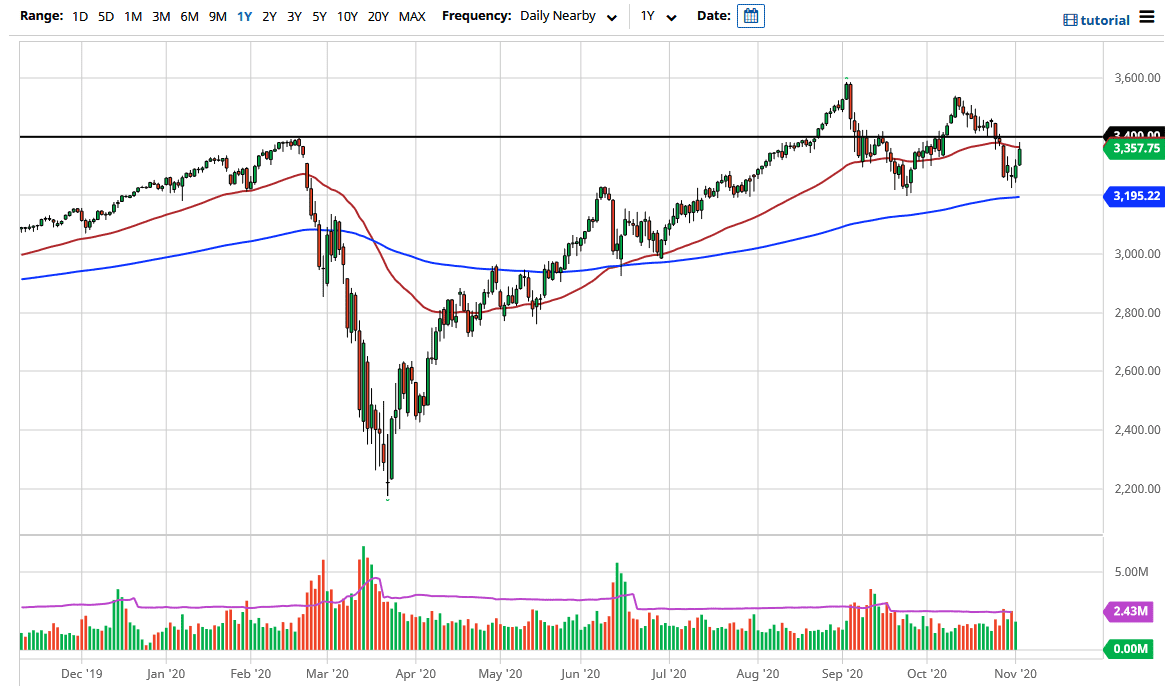

The 50-day EMA is sitting just above, so we might see sellers come in or perhaps even profit-taking in this general vicinity. The 3400 level will continue to be one area to which people will pay attention. It is likely going to be a scenario in which you buy the dips but have to be cautious about trying to jump in and take advantage of the market. This is a market that you should not be selling, and even if we were to break down below here, there are plenty of supportive levels underneath near the 3200 level. I like the idea of buying supportive daily candlesticks, and we have already seen what the market is ready to do. Once we get certainty, then this is a market that will continue to go looking towards the 3500 level. If we can break above there, then the market is likely to break out to fresh, new highs. If we get massive amounts of stimulus, that will likely be the catalyst. If we were to break down below the 200-day EMA, then we have to reassess the entire situation. However, if that happens, then I think what you are looking at is an opportunity to buy the US dollar, not necessarily a shorting opportunity.