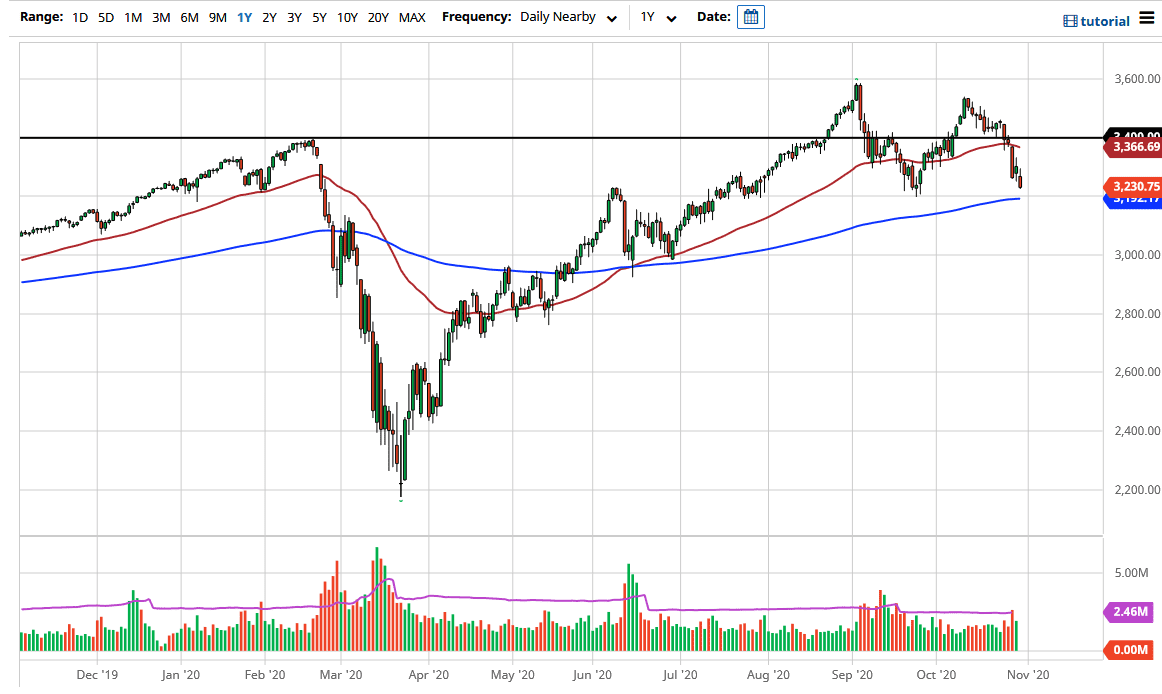

The S&P 500 has initially tried to rally during the trading session, but then broke down significantly to reach towards the 3230 level. This is a market that has been beaten on for a while, so it now looks like we are going to continue to see pressure going forward. If you think about current events, it clearly favors the downside because of so many problems out there just waiting to happen.

The United States dollar continues to strengthen, and that in itself will weigh upon the overall stock market. The 3200 level underneath is crucial, as it was the scene of the most recent bounce; and if we were to break down below there, we would then completely confirm the “double top”, or an “M pattern.” Typically, what happens is you double the size, which suggests that we are going to go down towards the 3000 handle. That could happen, because with the election noise out there a lot of people are going to continue to cause problems.

We also need to worry about the fact that the European Union is locking its borders down, and while that could give you a rush into the US markets, it might be a while before it truly takes off. Furthermore, that is probably more “hopium” than anything else. While I do not like shorting the S&P 500, I recognize if we break down below the 200 day EMA the trade is probably going to be buying the US dollar more than anything else.

If we did turn around a break above the top of the candlestick from Friday, that would be a bullish sign, but I think you probably have a lot of resistance above at the 50 day EMA, and then of course at the 3400 level. This is a market that I think continues to see a lot of noise, at least until we get some type of certainty after the election, which may not come until the end of next week. I would prefer to stay out of this market, and I would urge any of my friends to do the same.