The S&P 500 is going to continue to be very volatile due to the US elections having been a complete mess. Even if we do have a clear winner to the US presidential election, the reality is the congressional makeup is probably going to be much more important. The Senate is still Republican, and the House of Representatives actually shifted more towards the Republican Party. The market is likely to see less in the way of overall stimulus.

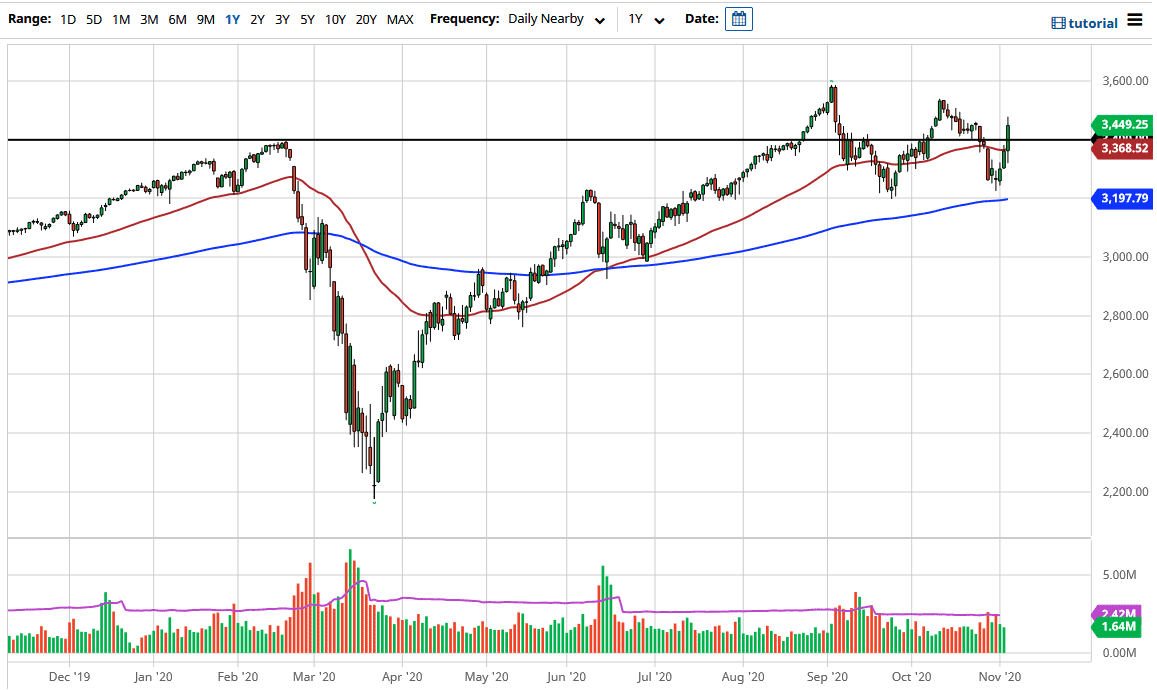

This is not to say that we will not get stimulus, but it will likely be smaller than we initially thought. The stock market will probably rally, but it will be short-term. Whether or not we can continue to go higher is a completely different story, but the internals were very lackluster. We have the 50-day EMA sitting underneath, which should offer some support, as we have the 3400 level as a fulcrum for price.

To the upside, I believe that the 3600 level is going to be significant resistance, and we still have not made a “higher high” yet, but it looks as if we are trying to do so. We continue to see a lot of back and forth action, and a severe lack of directionality in the short term. However, if we were to turn around and break down below the 3200 level, the market would be below the 200-day EMA. That would be a very negative turn of events, and it is possible that we could go down towards the 3000 handle. On the other hand, we can break above the 3600 level, and it is likely that we could go to the 3800 level, possibly even the 4000 level. But the only thing you can count on is a lot of nonsensical volatility, as now the market will be waiting to see whether or not the stimulus will be enough to get people excited. After all, the last 12 years have been about liquidity, and have had little to do with earnings.