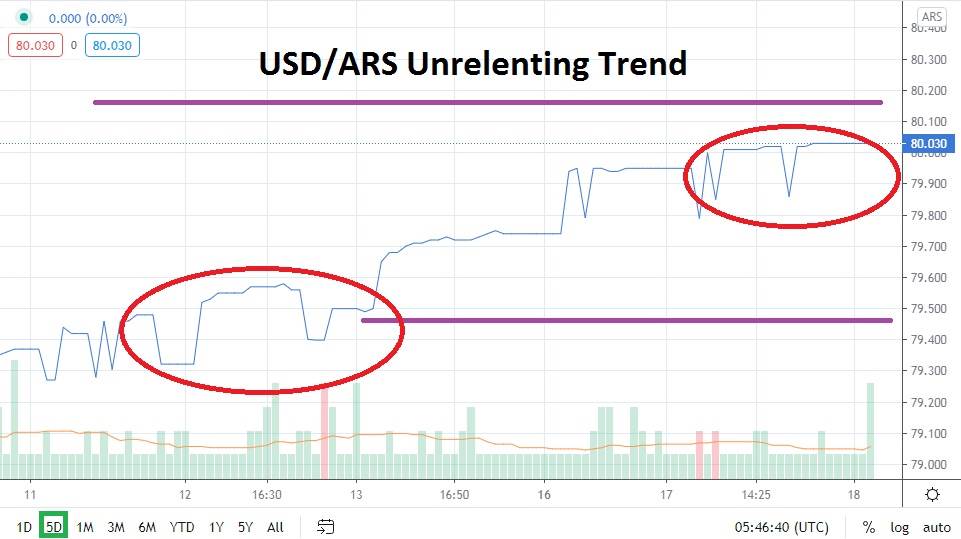

At some juncture, you may be inclined to suspect the USD/ARS is going to stop its bullish trend and some semblance of normality will occur for the Forex pair. However, the USD/ARS only continues to display explosive, upside,q bullish momentum. The official exchange rate from the Argentine government is now over 80.000 and the last month of trading has been no kinder than the previous two and half years. In April of 2018 the USD/ARS had a value of approximately 19.80 before it began to see an incremental rise take place, which has steadily destroyed resistance with relative ease.

In early January of this year, the USD/ARS was trading near the 60.000 juncture, which means the Forex pair has lost 25% of its total value since the beginning of this year. To make matters worse, the unofficial exchange rate for the USD/ARS on the street is easily twice the listed official value in Argentina. Citizens of the nation are suffering from the steep loss of value within the Argentina peso and the country is being torn at the seams as the currency becomes less valuable on a daily basis.

Traders need to be wary of the potential for sudden reversals which make take place downward, but buying the USD/ARS when it is possible and pursuing bullish momentum on Forex platforms remains the logical decision. In the past couple of days the Argentine government led by Peronist gatekeepers has begun what appears to be an official attack on the IMF verbally and by letter, which places blame for the current and past economic problems of Argentina squarely on the shoulders of the International Monetary Fund.

The current fiscal problems of the Argentine government aren’t going to be settled easily and there will be a resounding amount of failure if current economic policies within the nation are not changed. The policies of the government are not about to change, which means financial institutions internationally will remain extremely cautious about undertaking any activity in Argentina if it can be avoided. Meaning, the USD/ARS will continue to weaken unless something completely unforeseen takes place. Could the Argentine government announce a devaluation of the peso?

Traders need to use risk management while trading the USD/ARS, meaning they need to monitor their positions and be careful of overnight carrying charges if they seek to hold positions for longer durations. The USD/ARS is in disarray and speculators need to be wary of potential government intervention regarding the Argentina peso which could cause havoc. However, pursuing the bullish trend of the USD/ARS appears to be the only choice for most traders.

Argentine Peso Short Term Outlook:

- Current Resistance: 80.050

- Current Support: 79.850

- High Target: 80.100

- Low Target: 79.750