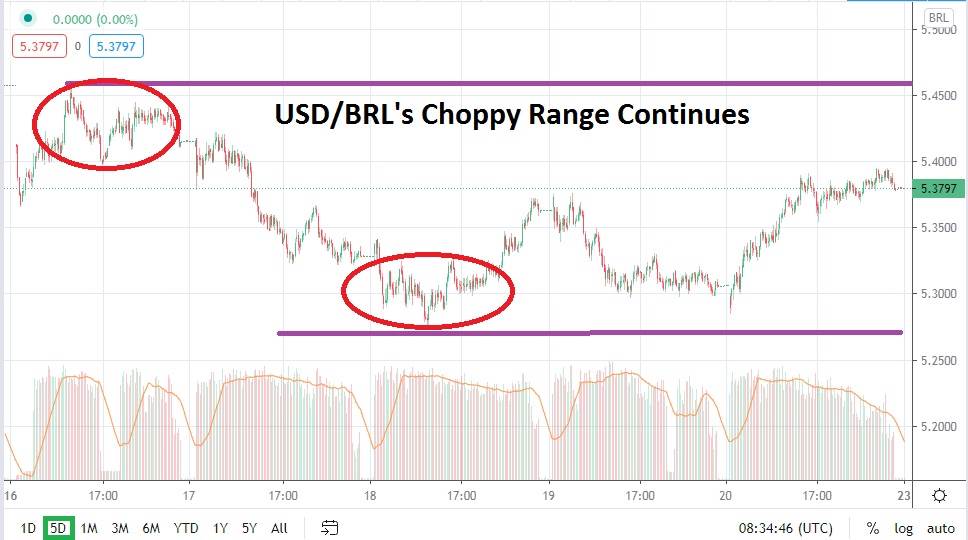

The USD/BRL has produced choppy conditions during the past few days of trading. After showing the capability to ‘return’ to a lower value band, the Brazilian real has not shown much ability to mount further tests of important support levels below. Again, the 5.3300 to 5.3000 junctures proved quite adequate and have demonstrated an instrumental tendency to generate slight reversals higher.

However, the price action within the USD/BRL the past couple of days has actually been consolidated too, and has proven that the Brazilian real remains within a value range which continues to produce what financial institutions may refer to as a 'polite equilibrium'. This price range may allow speculators to wager on both sides of the speculative coin and test values using limit orders to protect against a sudden onslaught of volatility.

Risk appetite in the global markets has been rather steady. However, there are swirling winds concerning coronavirus infection rates, while there is also optimistic talk about vaccines which appear to signal a ray of hope in conquering the pandemic. Timetables remain sketchy for a complete cure, though, and this adds to rather combustible behavioral sentiment which remains fragile. Technically, the USD/BRL has shown a tendency to produce mixed trading and speculators should continue to pursue short-term trends using solid risk management.

Interestingly, resistance levels for the USD/BRL have shown an ability to incrementally lower the past couple of days, which may generate speculative selling by traders. The current price vicinity of the USD/BRL near 5.3800 is approaching highs not challenged since the 17th of November. A higher target of 5.4200 to 5.4500 appears well within the capability of the USD/BRL, which may make it an attractive short-term buy. If resistance near the 5.4700 level proves durable, speculators may want to venture a selling position and seek reversals lower too.

The consolidated movement of the USD/BRL may remain an opportunity for traders to take advantage of its current price range. Speculators will need to remain attentive and use stop loss orders to protect against sudden volatility which is possible, but they should also use take profit orders to capitalize on price action and grab profits quickly, which may remain limited in scope near term as the USD/BRL fights for direction.

Brazilian Real Short Term Outlook:

- Current Resistance: 5.4220

- Current Support: 5.3300

- High Target: 5.4700

- Low Target: 5.2800