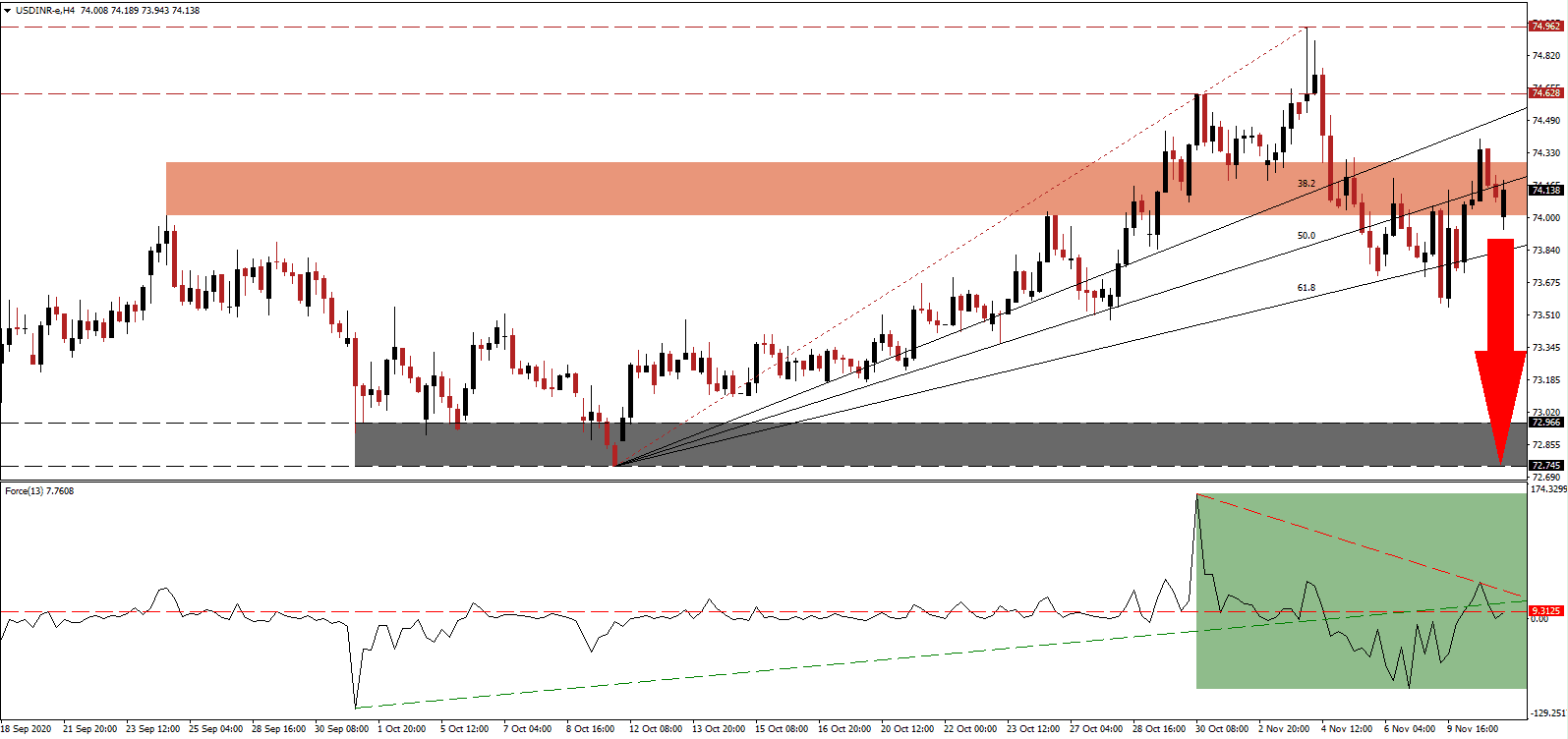

With new daily COVID-19 infections receding from their peak and settling at an uncomfortably high range above 40,000, Prime Minister Narendra Modi claims the economy stabilized, and all sectors are expanding. He added that his government is in the final stages of finalizing an ambitious $1.5 trillion infrastructure plan to create jobs and modernize the world’s fifth-largest economy. Bearish momentum continues to dominate the USD/INR, which is likely to extend its correction following a breakdown below its short-term resistance zone.

The Force Index, a next-generation technical indicator, recovered from its most recent low but swiftly reversed below its ascending support level and its horizontal resistance level, as marked by the green rectangle. It resulted in an adjustment to the descending resistance level, which maintains downside pressure. Bears wait for this technical indicator to cross below the 0 center-line to regain complete control over the USD/INR.

Minister of Finance Nirmala Sitharaman acknowledged challenges ahead, but also noted that India has to find a way to continue doing business amid the COVID-19 pandemic. She added that the government is considering setting up large state-owned banks to assist companies during the transition to a new normal and beyond. The USD/INR presently challenges its adjusted short-term resistance zone located between 74.011 and 74.277, as marked by the red rectangle.

While Prime Minister Modi addressed a round table attended by 20 international investment funds with over $6 trillion under management, the government also pins hope on the rural agricultural sector as an engine of growth. Indian farmers are often neglected and ignored but have kept India afloat. Another year of record crops is expected to boost the sector. A breakdown in the USD/INR below its ascending 61.8 Fibonacci Retracement Fan Support Level can lead to an accelerated sell-off into its support zone between 72.745 and 72.966, as identified by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Acceleration Scenario

Short Entry @ 74.150

Take Profit @ 72.750

Stop Loss @ 74.500

Downside Potential: 14,000 pips

Upside Risk: 3,500 pips

Risk/Reward Ratio: 4.00

Should the Force Index eclipse its descending resistance level, the USD/INR can attempt another push higher. The upside potential remains limited to its resistance zone between 74.628 and 74.962. Forex traders should sell any advance amid a worsening outlook for the US dollar, where a Biden presidency seeks to add more debt. The second wave of the COVID-19 pandemic accelerates, and more restrictions are likely.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 74.650

Take Profit @ 74.950

Stop Loss @ 74.500

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00