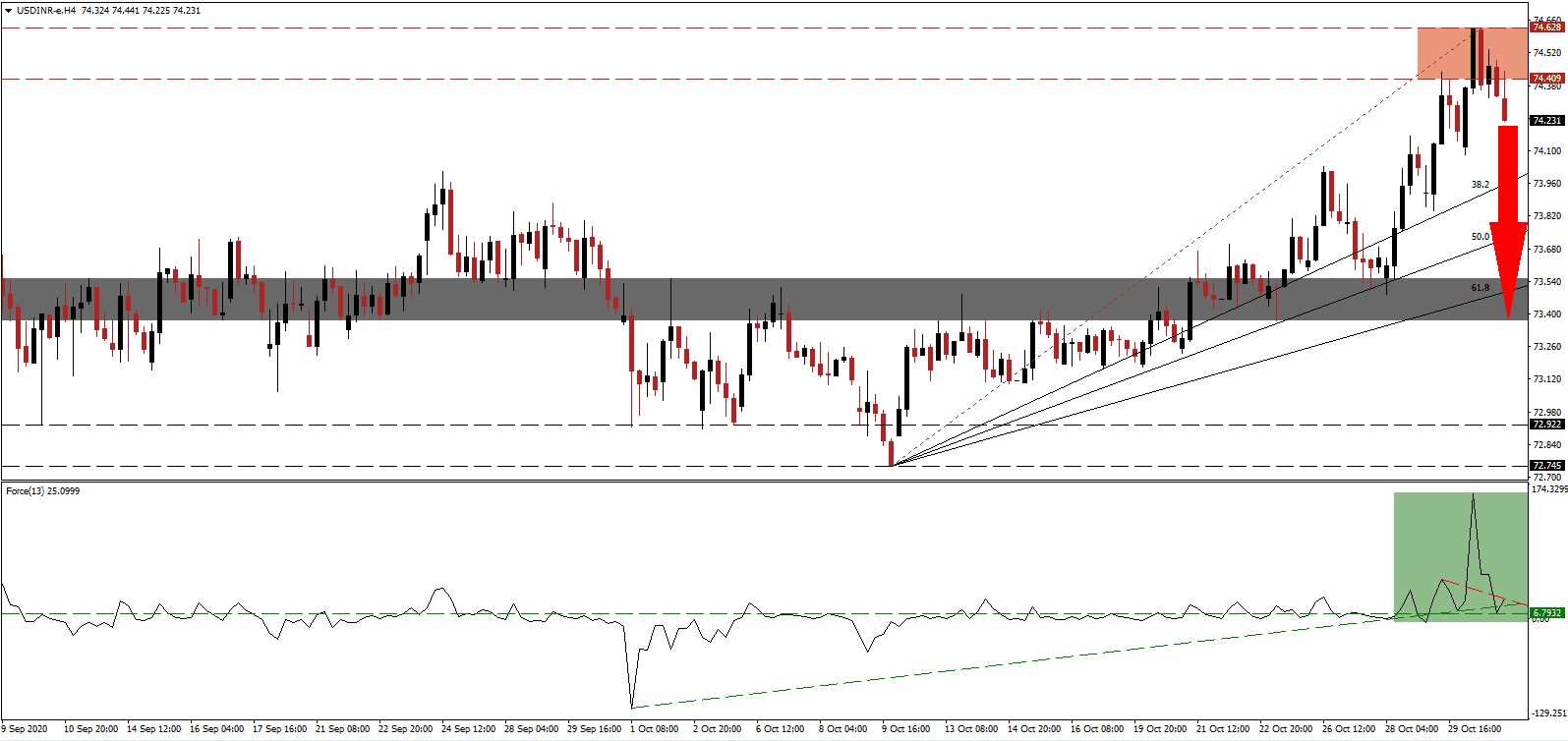

India continues its gradual recovery with the manufacturing PMI for October clocking in at 58.9, well above expectations for a slowdown to 55.4 from the 56.8 printed in September. It follows manufacturing data, which suggested a more robust post-Covid-19 lockdown recovery. It remains unclear how much of it was related to inventory rebuilding ahead of more restrictions over the next few months, limiting demand. France, Germany, and the UK announced a new four-week lockdown. India holds on to the number two spot for most-infected countries, trailing only the US, where the virus rages out of control. The USD/INR enjoyed a massive bullish push, but the breakdown halted the advance.

The Force Index, a next-generation technical indicator, confirmed the advance with a brief spike to a multi-week high before swiftly collapsing. It was able to bounce off of its horizontal support level and recovered back above its ascending support level. It now challenges the redrawn descending resistance level, as marked by the green rectangle. Neither bulls nor bears have a convincing upper hand over the USD/INR, but the bullish momentum reversal in this technical indicator suggests bears may prevail.

Adding to bullish momentum for the Indian economy is the second consecutive monthly increase in revenues from goods and services tax (GST) collections. Ajay Pandey, the Revenue Secretary of India, confirmed GST posted the first year-over-year increase since the start of the pandemic. He added that the government of Prime Minister Narendra Modi is open to more stimulus if needed. Following the breakdown in the USD/INR below its resistance zone located between 74.409 and 74.628, as identified by the red rectangle, bearish momentum is accumulating.

Sangita Reddy, the President of the Federation of Indian Chambers of Commerce & Industry (FICCI), echoes the upbeat assessment of the Indian economy. Duvvuri Subbarao, the former Governor of the Reserve Bank of India, warned that bad loans would harm the recovery. The October unemployment rate also rose to 6.98% from 6.67% reported in September. Remittances are also set to fall after a 67% plunge in overseas employment opportunities for Indian emigrants. The USD/INR may extend its breakdown into its short-term support zone located between 73.370 and 73.550, as marked by the grey rectangle, while the ascending 61.8 Fibonacci Retracement Fan Support Level on course to move above it.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 74.230

- Take Profit @ 73.380

- Stop Loss @ 74.480

- Downside Potential: 8,500 pips

- Upside Risk: 2,500 pips

- Risk/Reward Ratio: 3.40

A sustained breakout in the Force Index above its descending resistance level could lead the USD/INR into a secondary push higher. The US Dollar remains under long-term bearish pressure, and the US election, together with increasing localized restrictions across the US, cloud the outlook. Forex traders should consider more upside as a selling opportunity, with the next resistance zone located between 75.071 and 75.232.

USD/INR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 74.680

- Take Profit @ 74.350

- Stop Loss @ 75.080

- Upside Potential: 4,000 pips

- Downside Risk: 2,000 pips

- Risk/Reward Ratio: 2.00