Europe and the US appear overwhelmed with the second wave of the Covid-19 infection, where a public tired of restrictions is on course to pressure the healthcare system into a breakdown. Japan, known for a highly disciplined society, keeps the pandemic under control, reporting less than 1,000 new daily infections and fewer than 7,000 active cases in a population above 126,000,000. The USD/JPY extended its correction after the US Federal Reserve maintained its weak US Dollar policy and is presently challenging its support zone.

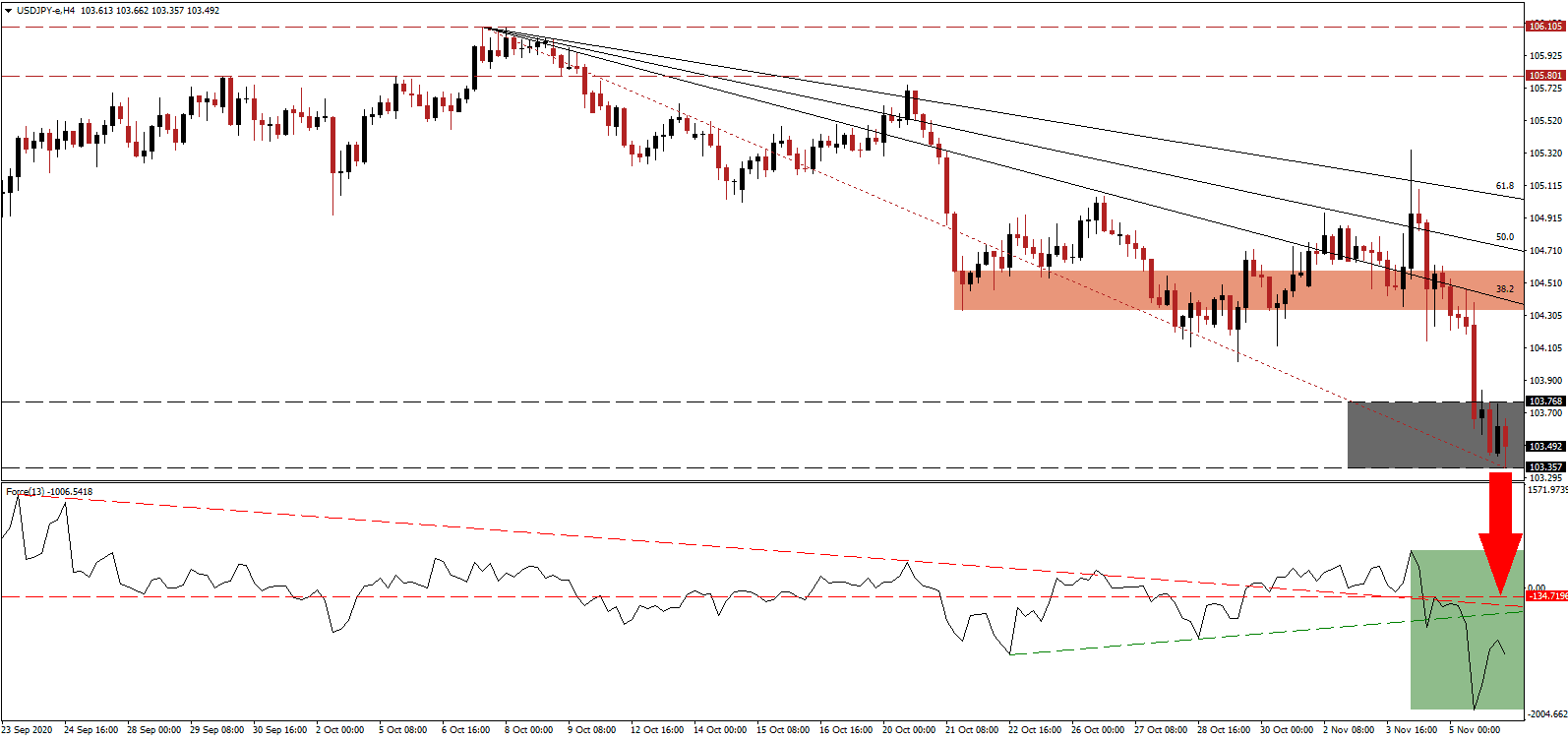

The Force Index, a next-generation technical indicator, plunged to a new multi-week low before a partial recovery. Following the move below its horizontal resistance level, a swift contraction through its descending resistance level resulted in a collapse below its ascending support level, as marked by the green rectangle. Bears remain in complete control over the USD/JPY, with this technical indicator deep in negative territory.

Seasonally adjusted Household spending for September in Japan increased by 3.8%, the second consecutive expansion. It remains a highly volatile data point but accounts for nearly 50% of Japanese GDP. A Ministry of Internal Affairs and Communications official credited the improvement to a manageable Covid-19 count. Personal income rose for the ninth month in a row, adding a boost to spending power. The breakdown in the USD/JPY below its short-term resistance zone located between 104.339 and 104.584, as marked by the red rectangle, magnified dominant bearish momentum.

Japanese Prime Minister Yoshihide Suga outlined digitalization as essential to improve productivity and adjust to the new normal in a post-Covid-19 global economy. A willingness to change will position Japan on a superior growth trajectory compared to those who use debt to maintain the pre-Covid-19 pandemic economy. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/JPY into a breakdown below its support zone located between 103.357 and 103.768, as identified by the grey rectangle. Price action will face its next support zone between 101.170 and 101.997.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 103.500

- Take Profit @ 101.500

- Stop Loss @ 104.150

- Downside Potential: 200 pips

- Upside Risk: 65 pips

- Risk/Reward Ratio: 3.08

Should the Force Index accelerate above its descending resistance level, the USD/JPY could attempt a short-covering rally. Forex traders should take any price spike as an opportunity to enter new short positions. The US labor market continues to show weakness, over 100,000 new Covid-19 infections daily force more restrictions, and debt continues to grow. With the long-term US Dollar outlook bearish, the upside potential remains reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/JPY Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 104.500

- Take Profit @ 105.000

- Stop Loss @ 104.150

- Upside Potential: 50 pips

- Downside Risk: 35 pips

- Risk/Reward Ratio: 1.43