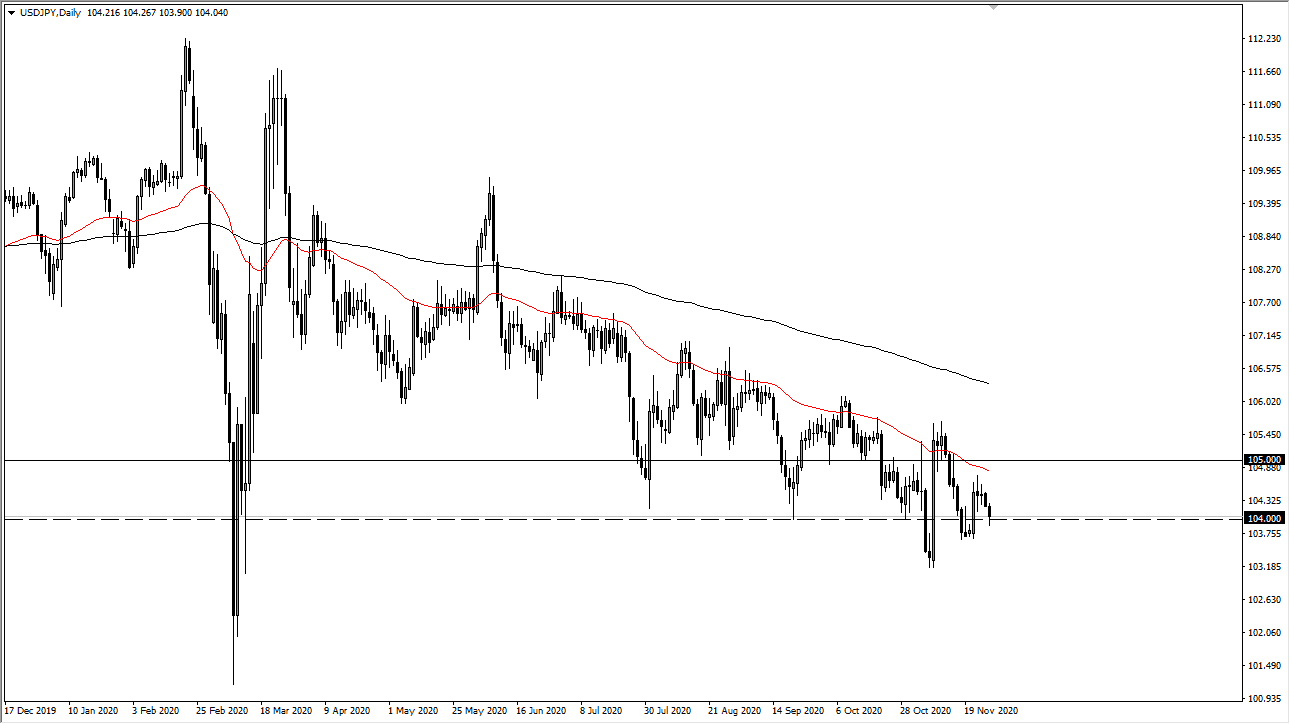

The US dollar fell slightly during the trading session on Friday, breaking down below the ¥104 level. We bounced back above it, showing signs of support, and now it looks like we will eventually go lower. But if we rally from here, you will be looking at a selling opportunity above, especially near the 50-day EMA - which has been very resistive - and extending all the way to the 200-day EMA. There is a large amount of selling between that area, because when you look at this chart, you can see that there is a huge gap between those two moving averages.

We can either fade short-term rallies, especially near the aforementioned 50-day EMA, but we can also sell on a breakdown below the candlestick for the Friday session. Either way, keep in mind that the Federal Reserve continues to loosen monetary policy and the US dollar has sold off against almost everything. That could continue, so you need to keep an eye on everything at the same time, or perhaps just look at the US Dollar Index. If we break down below the support that we are currently sitting on in that index, then we could see this pair follow right along.

One thing that you may notice since we got the vaccine news is that we have started to form a symmetrical triangle, which shows that the market is trying to figure out where to go next. Nonetheless, we are still in a very significant downtrend, which means that we are going to see more selling pressure than buying over the long term. I think that will continue to be the case, and eventually we will break down below the ¥103.25 level to reach down towards the ¥102 level after that. Fading short-term rallies will continue to be the way to trade this market, but also recognize that it is very noisy. If you think about it, it does make sense that we have fluctuated due to the fact that the Japanese yen is better as a safety currency as well.